In a seller’s market, where demand outweighs supply and properties often receive multiple offers, buyers need to do everything they can to give themselves the upper hand.

One of the most powerful ways to strengthen their position when competing with other buyers is to submit a firm offer-to-purchase.

Think about it - if you’re a seller with two offers in front of you and one of them is conditional upon the buyer arranging financing and the other one isn’t (all other things being equal), which one are you going to go with?

Accepting a firm offer means there’s no waiting period to suffer through with the possibility that the buyer will walk away from the deal.

A firm offer means you can go to bed that night knowing that you’re property is sold and it’s a done deal.

Peace-of-mind like this carries a lot of weight.

Keep in mind though; submitting a firm offer is not to be taken lightly.

Preparation is key and there’s work to be done ahead of time by the buyer, their realtor, their mortgage broker, and possibly their lawyer.

Financing Condition:

Obtaining a mortgage pre-approval is crucial, but it’s not worth much if your broker is surprised with significant details when the time comes to actually arrange the financing (eg. “I forgot to mention that I’ve got a $30,000 student loan I’m slowly chipping away at.”).

Be sure to provide accurate income and debt figures so that your pre-approval is solid and you can comfortably go in without this condition.

Home Inspection Condition:

If the sellers are "holding-back" on offers, get in there and have a home inspection done prior to the offer date.

Yes, it’s going to cost you approx $600.00 and you may not even end up getting the property.

But six hundred bucks is peanuts compared to the hundreds of thousands (or more!) you’ll be dropping on your home purchase.

Having the inspection done ahead of time will allow you to come to the table sans condition and give you a better shot at sealing the deal.

A number of sellers will actually have their own “pre-listing” home inspection done ahead of time and the results will be made available to all prospective buyers.

Status Certificate Condition (condominiums):

The best case scenario here is that the seller has already obtained a current Status Certificate and copies are made available to all prospective buyers for their lawyers to review prior to the offer date.

If the docs are not available ahead of time, the buyer and their realtor need to have a discussion about the risks of submitting a firm offer without seeing the Status Certificate.

There is some homework that the realtor can do to give their client some peace-of-mind in this area, but it needs to be clear that there are still risks involved and nothing can substitute for a lawyer's thorough review of the documents.

Succeeding as a buyer in a seller's market is hard work.

There's plenty of competition out there right now and you need to find every advantage you can.

Being able to submit a firm offer certainly tips the scales in your favour.

If you’re thinking of making a move and would like to know how we can help, please to contact us for more info.

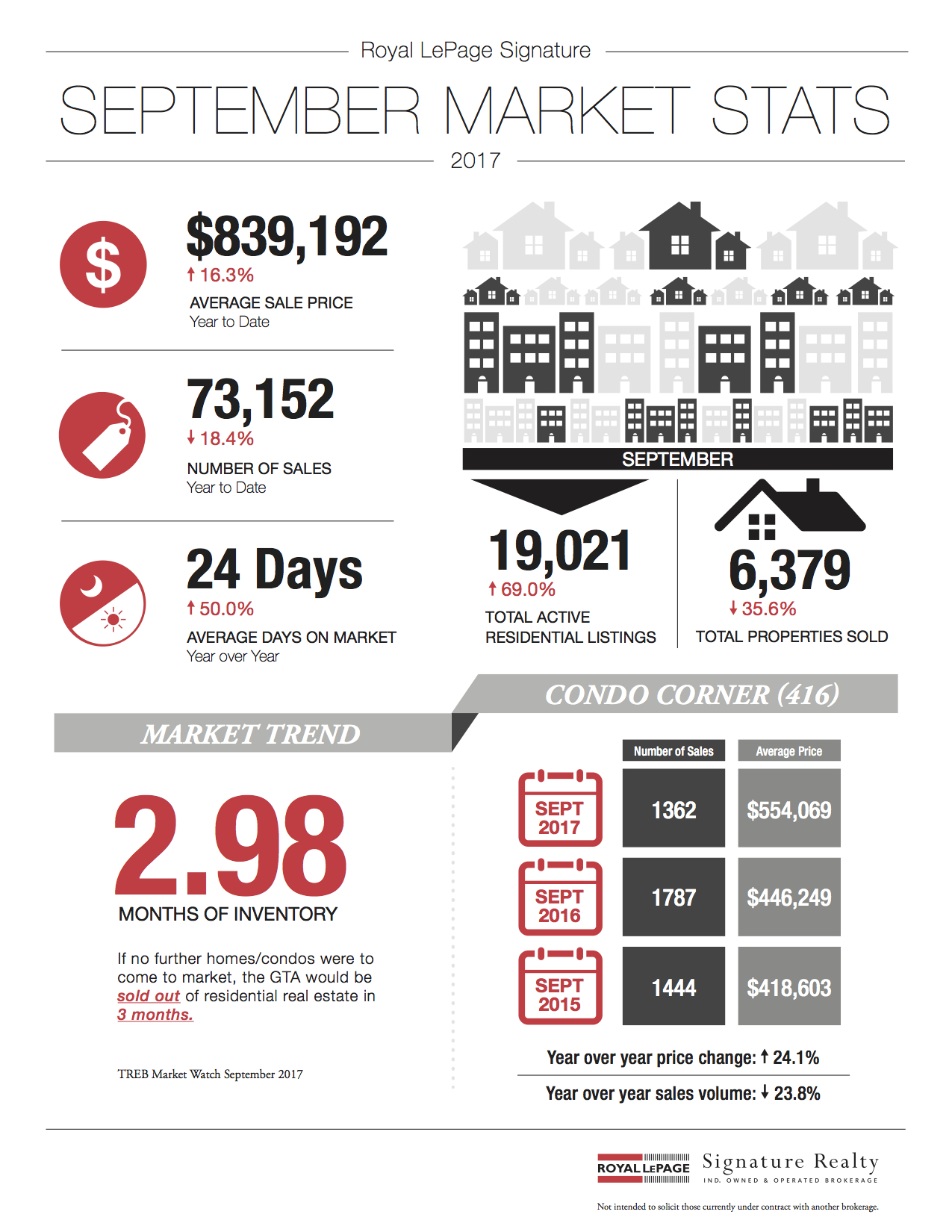

September 2017 market stats are here!

September 2017 market stats are here!

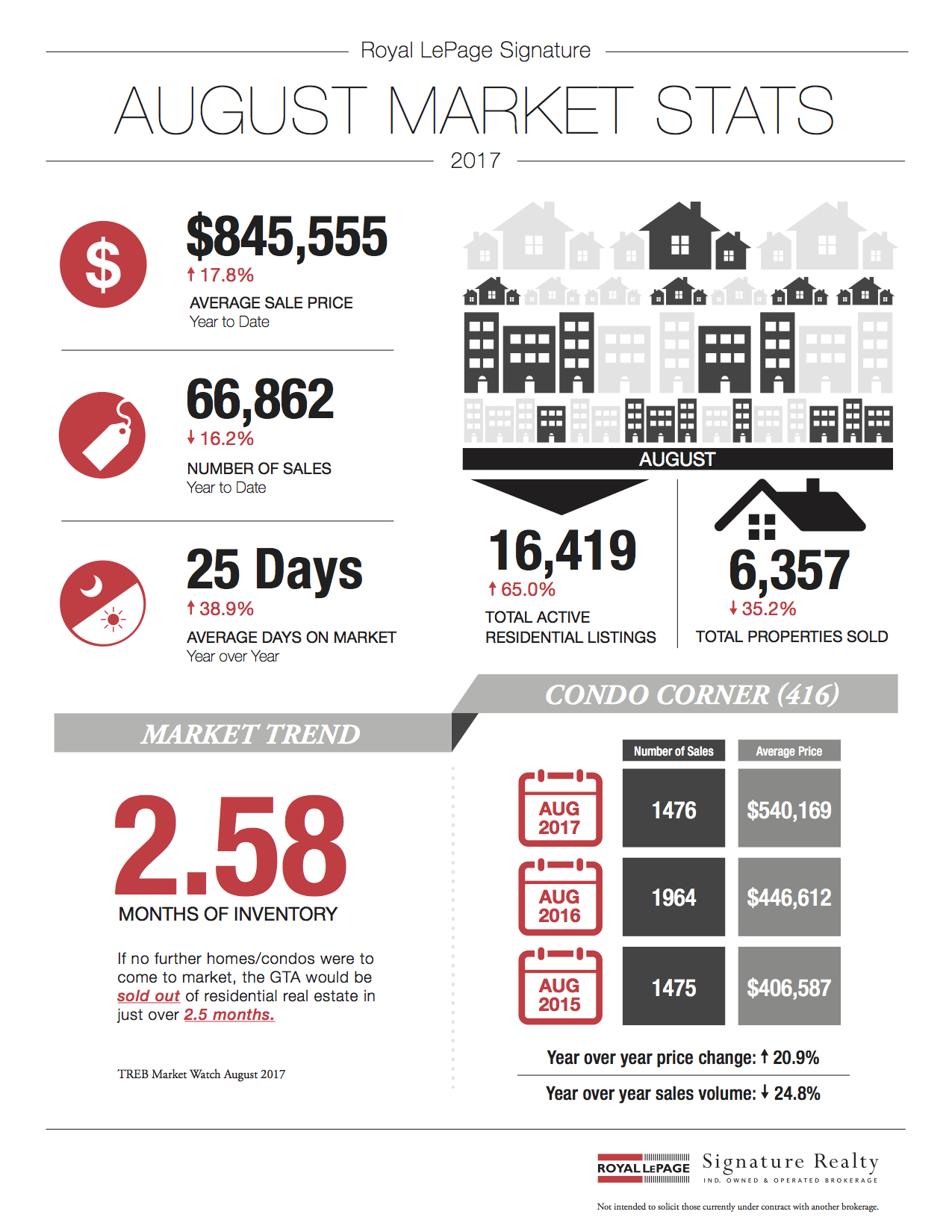

Following is TREB’s market report for August 2017:

Following is TREB’s market report for August 2017: