October 2022 market stats are here!

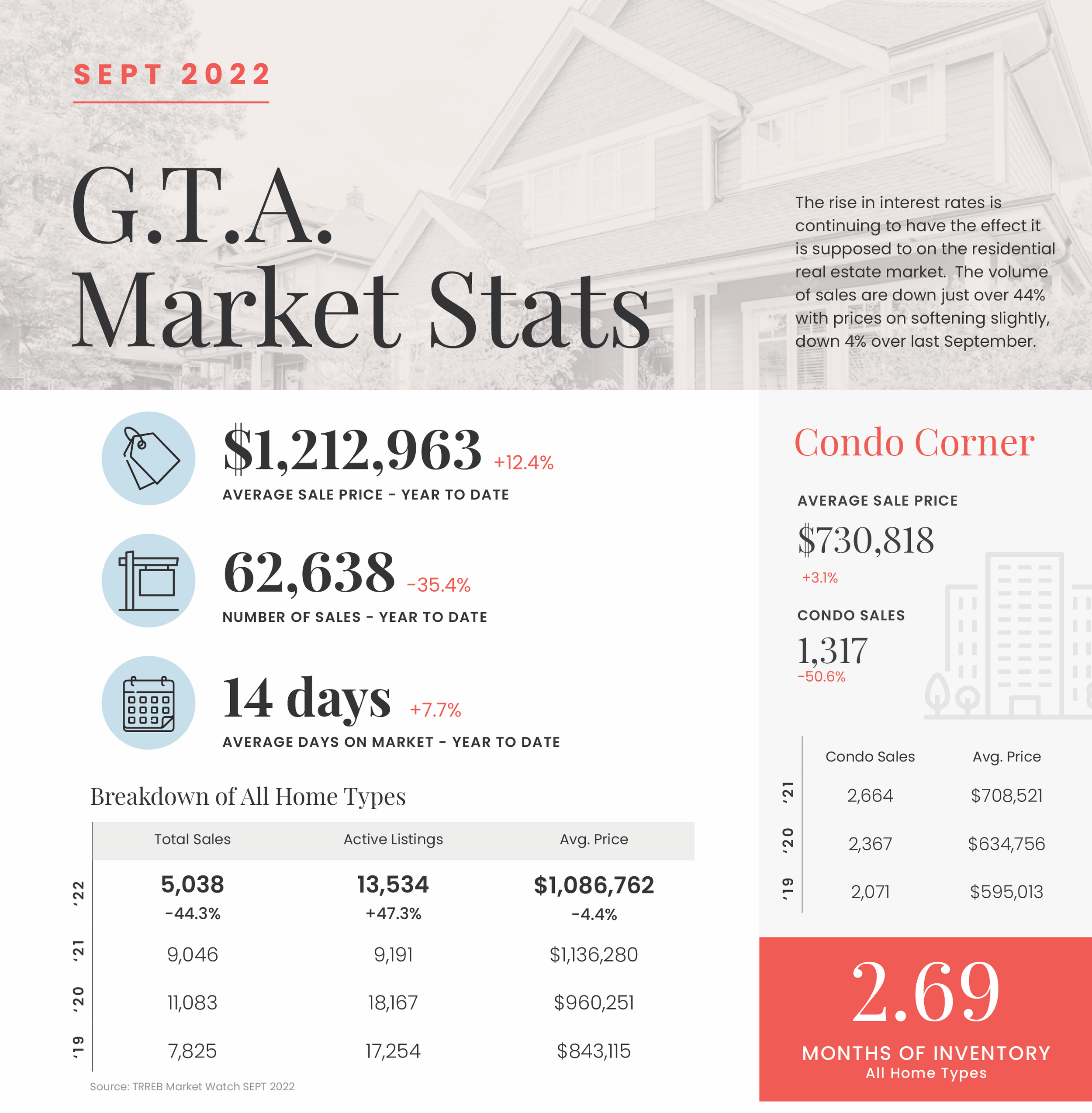

The residential real estate market continues to adjust and prices seem to have hit a consistent threshold where the average sale price of all home types in October is almost equal to September's average price ($1,089,428 and $1,086,762 respectively).

The active number of listings has seen the greatest change, up 68% compared to the same month last year. At the end of October there were over 13,000 homes available for sale, there were only 7,750 at this same time last year.

Another figure we watch is the number of monthly sales, down just over 49%. Last October there were exactly 9,783 homes sold, this October there were 4,961. With rising interest rates, fewer homes are being sold and inventory levels have begun to rise, putting downward pressure on prices, down almost 6% compared to October last year.

No one likes to see the value of their home depreciate, however, the positive outlook in situations like this is that the months of available homes for sale continue to remain low with only 2.63 month of available inventory. If another home, of any type, was not to come up for sale the GTA would be sold out of residential real estate in under three months. A city the size of ours needs a lot of inventory to really see a major shift in prices as we simply do not have the inventory of available homes to currently do that.

Condominium sales continue to remain constant, appreciating 2% compared to October of last year. Even with the volume of trades down almost 60% for this home type, condominiums continue to be an affordable way to own real estate in this great city.

If you’re thinking of making a move and would like to know how we can help, please contact us for more info.