More than once over the course of these past few months, I've seen a house come on the market and sell for significantly more than what it was unsuccessfully listed at back in the fall/winter.

More than once over the course of these past few months, I've seen a house come on the market and sell for significantly more than what it was unsuccessfully listed at back in the fall/winter.

You could argue that this makes sense - that in a rising market a house should sell for more now than it would’ve 6 months ago.

Maybe, maybe not. (More on that towards the end of this blog post).

Regardless, it’s interesting to see such a scenario play out in real time with one specific property.

Here’s a breakdown of what happened with one of the houses I’m referring to:

House is listed in June 2015

Located in a very hot area in the west-end of the city.

Priced at $679,000, with a hold-back on offers.

Offer night comes and goes, and the property doesn’t sell.

They re-list the following day at $719,000, with offers welcome anytime.

After 3 more weeks without selling, they take it off the market.

Same house is re-listed in February 2016

7 months after unsuccessfully trying to sell, they’re back on the market.

Priced again at $719,000, with offers welcome anytime.

In less than 24hrs they receive 3 competing offers and the house sells for $755,000 (105% of list price).

No one wanted the house back in the summer, but by winter’s end there were three buyers tripping over each other to pay well above the asking price.

Wow! What a difference a season (or two) makes.

Does this necessarily mean that the same scenario would play out for every single house listed for sale in the Toronto real estate market right now? Is every single seller out there guaranteed to sell for significantly more if they just wait another 6 months?

Not necessarily. I’m sure there are sellers out there who did better 6 months ago than they would today, for a number of reasons; maybe they were competing with fewer similar listings than they would be today, maybe there were more buyers in the market that week for their particular house than there would be this week, etc.

On the whole though, prices are increasing and you’ll very likely pay more for a house 6 months from now. Just ask the three buyers who bid on the house in my example above.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

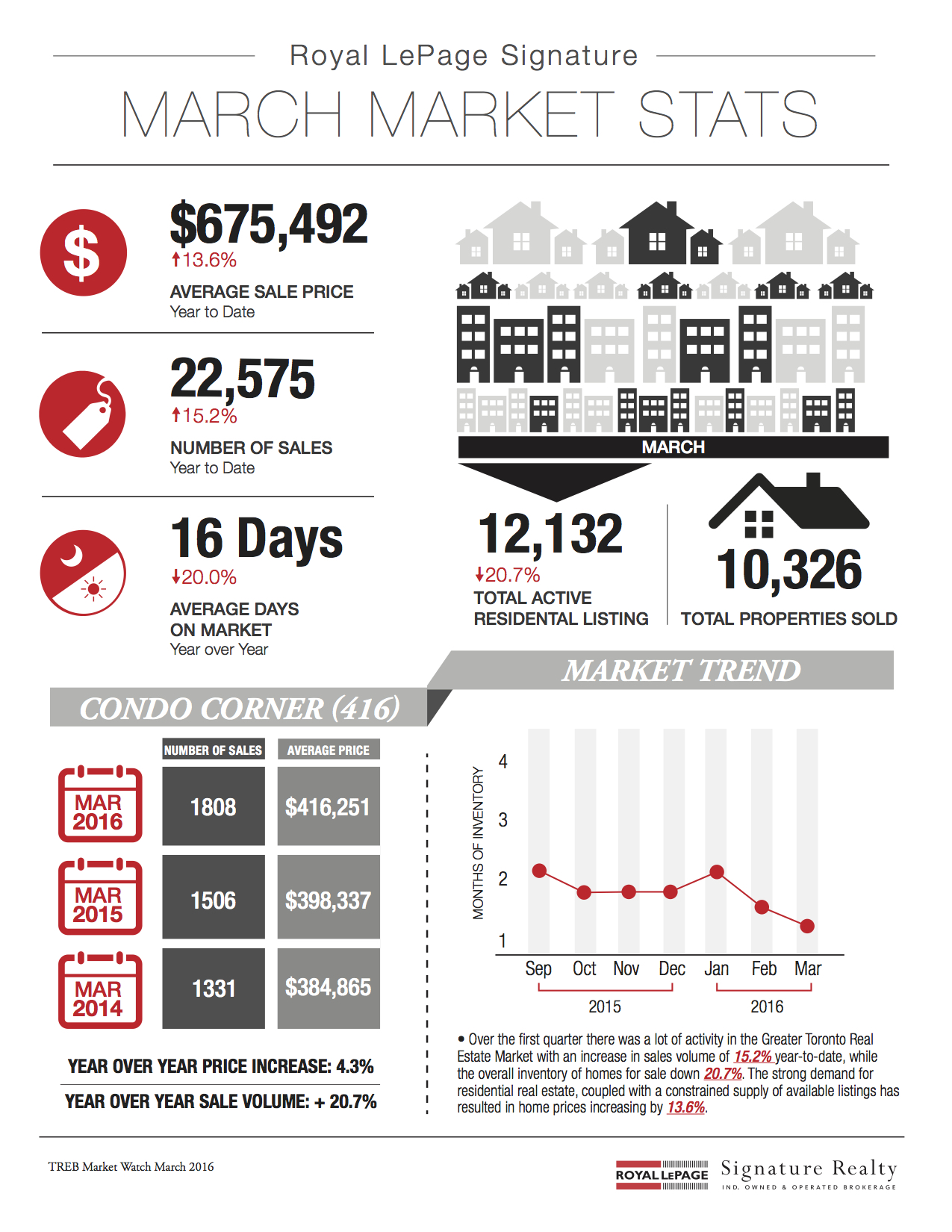

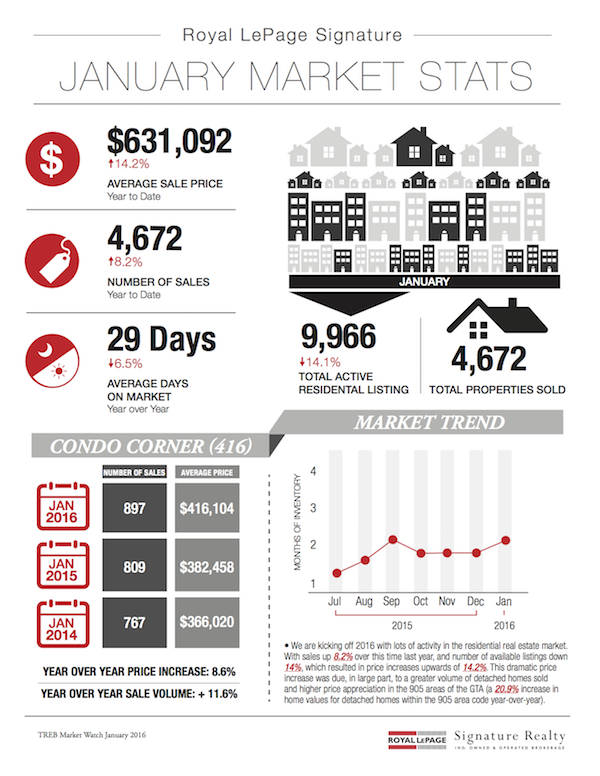

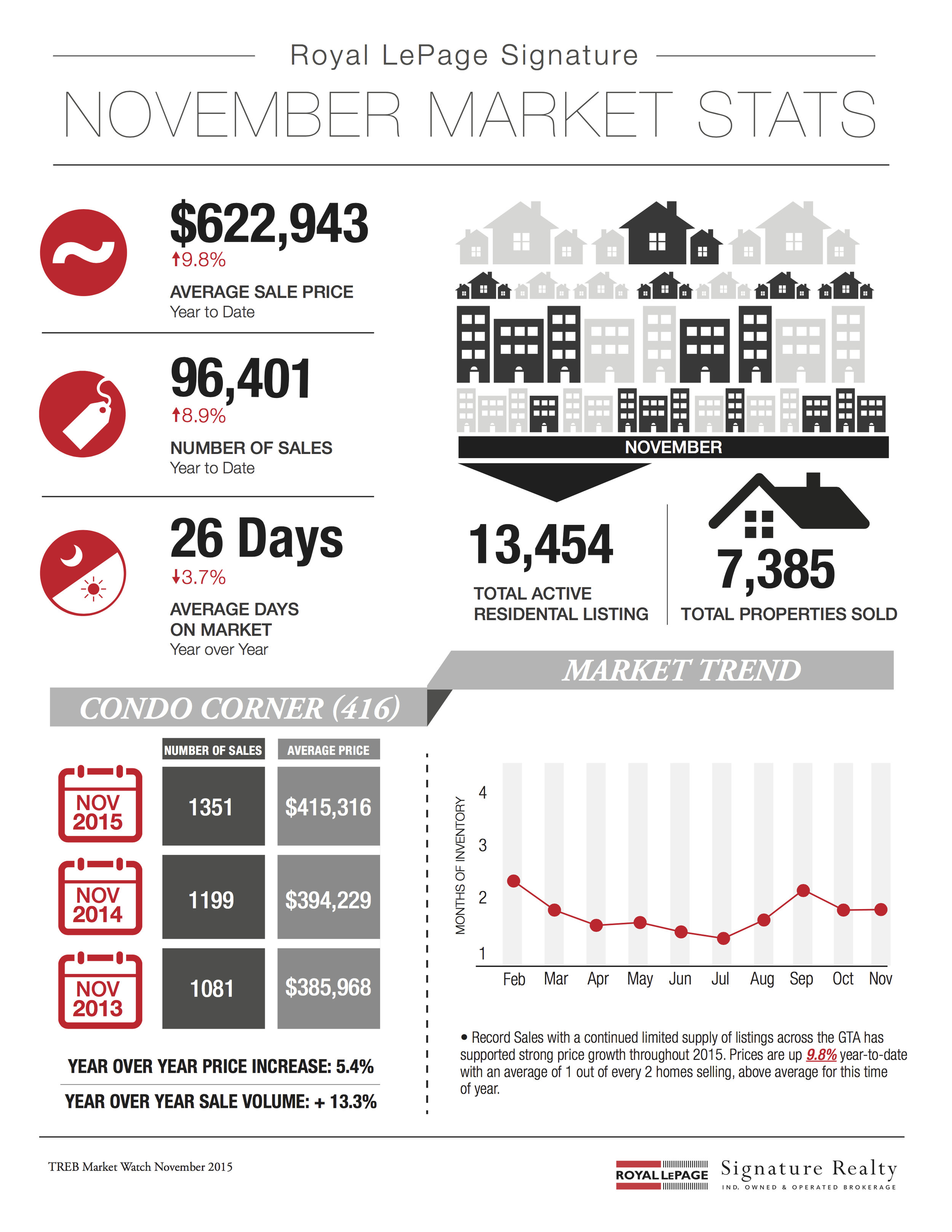

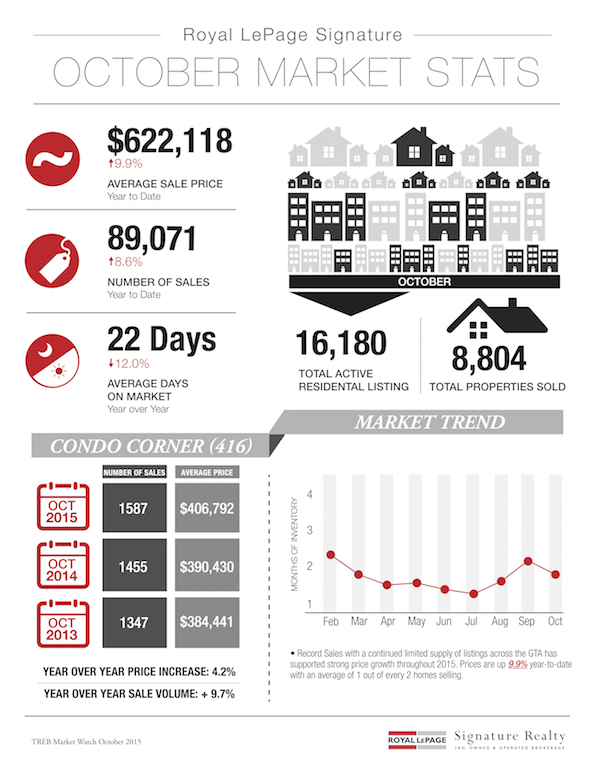

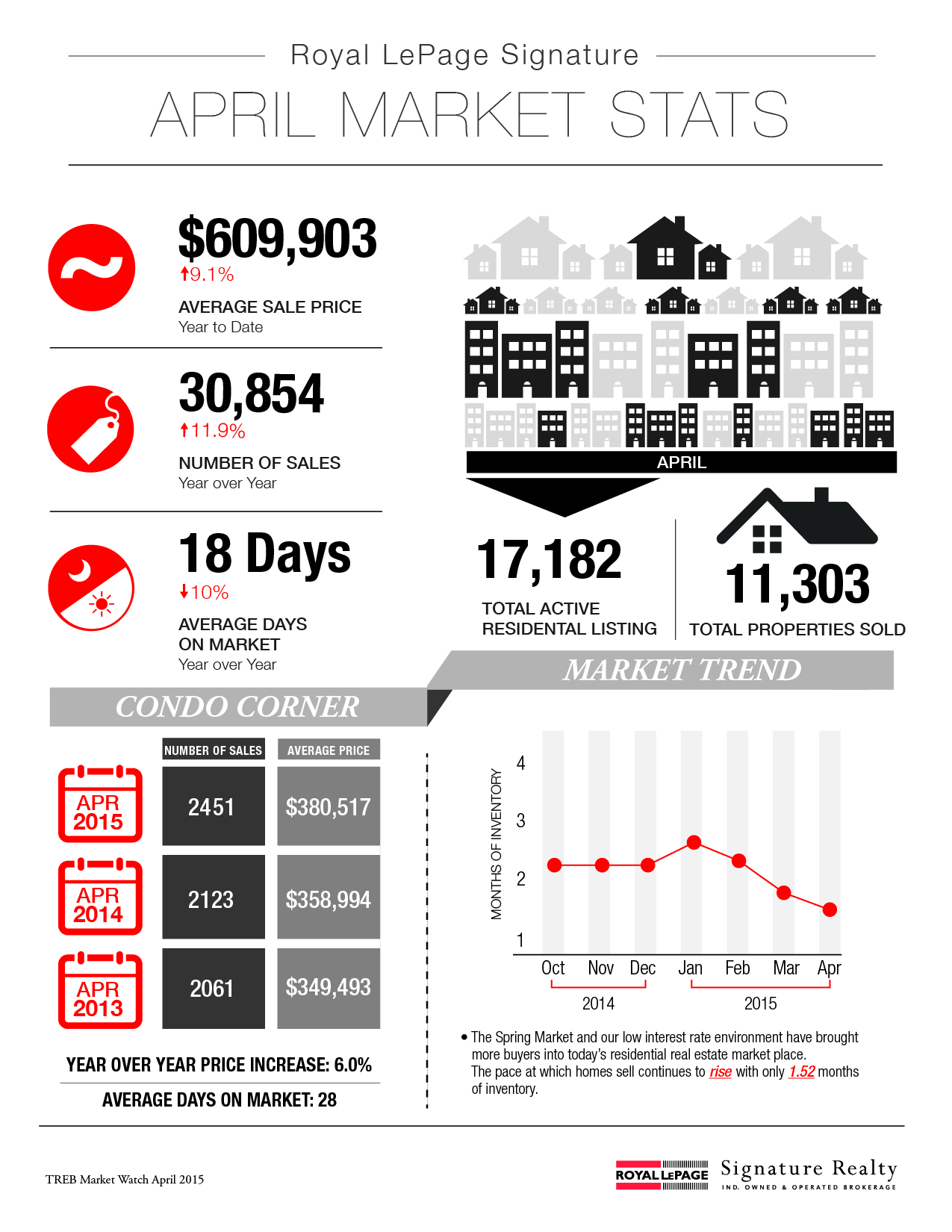

Following is TREB's market report for November 2015:

Following is TREB's market report for November 2015:

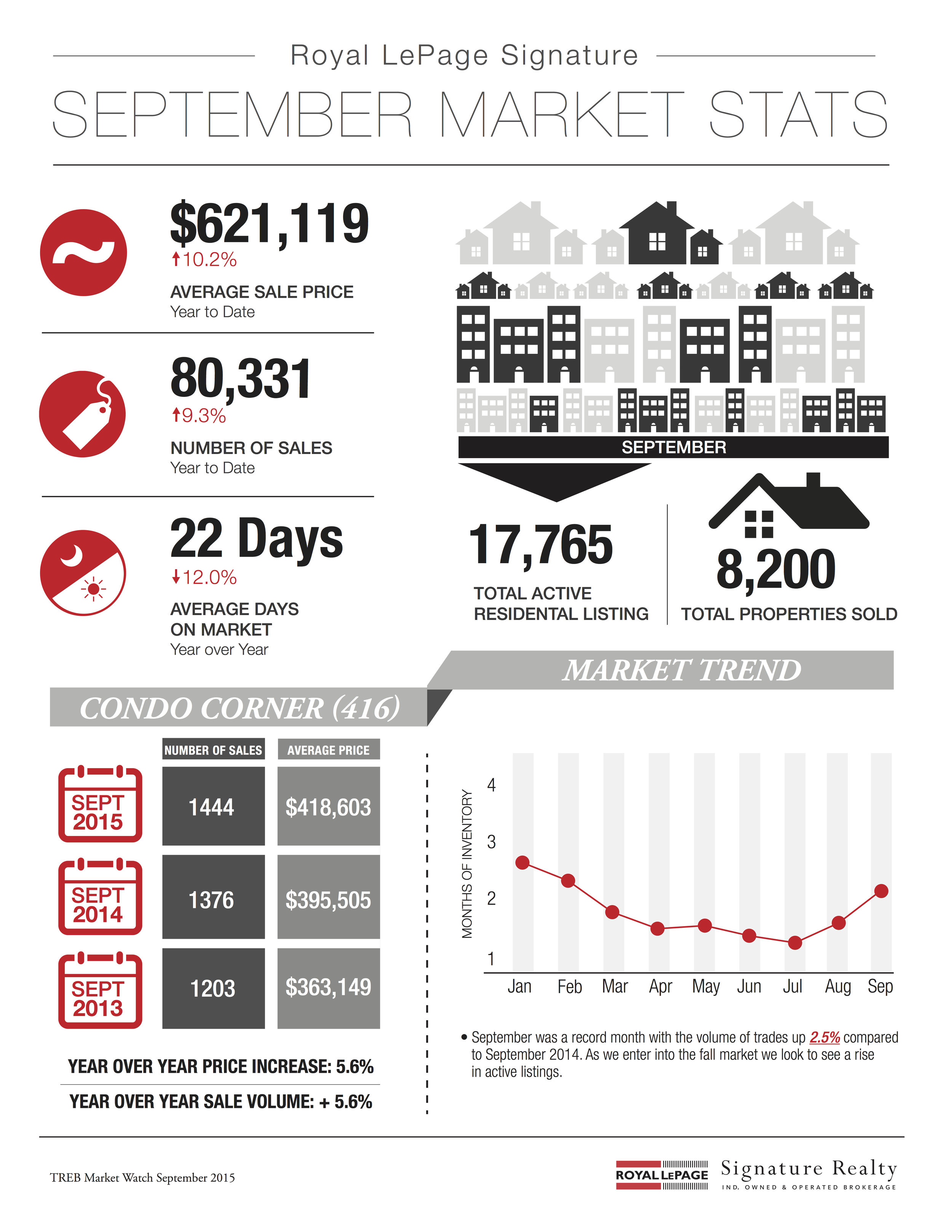

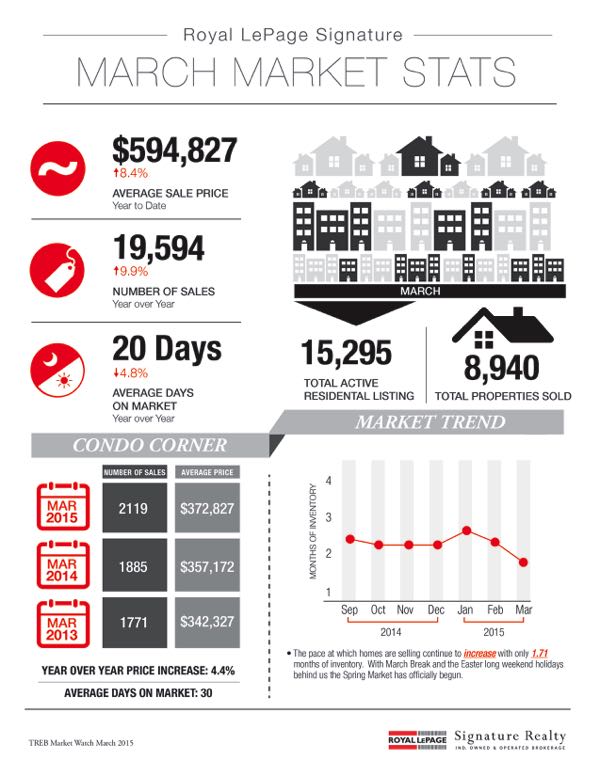

Following is TREB's market report for September 2015:

Following is TREB's market report for September 2015:

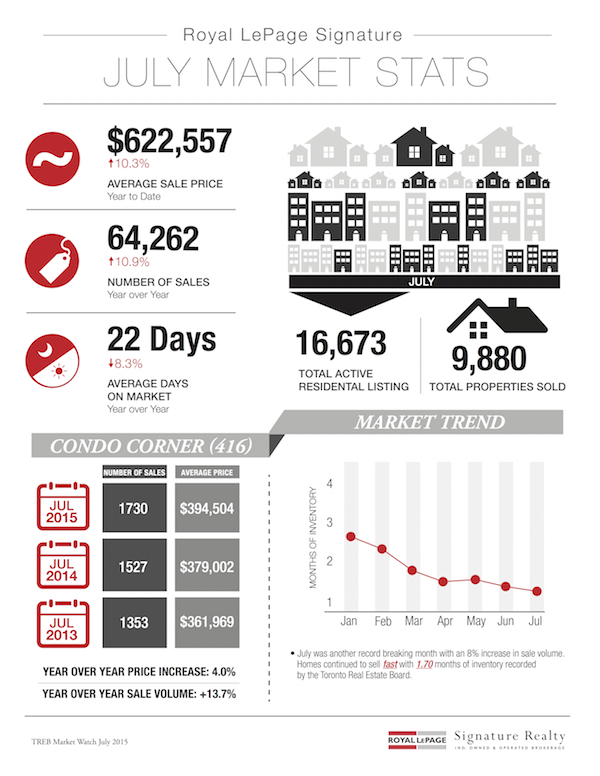

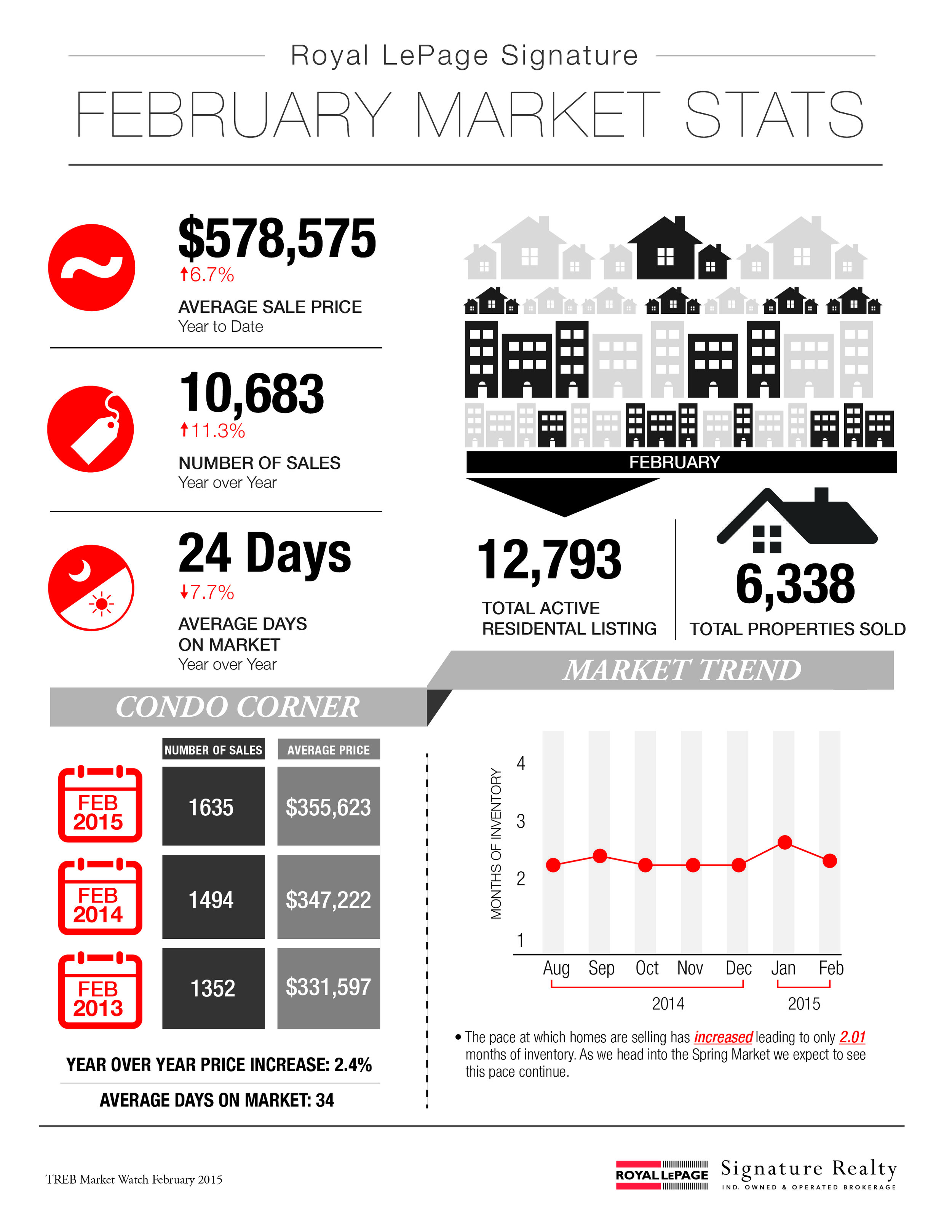

Following is TREB's market report for July 2015:

Following is TREB's market report for July 2015:

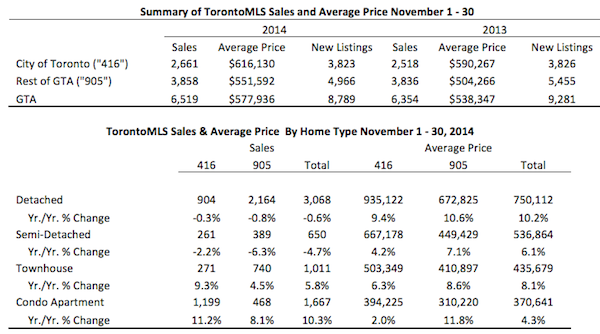

Following is TREB’s market report for November 2014:

Following is TREB’s market report for November 2014:

Back in August I wrote about the sellers who received 7 competing offers on offer-night, and said "no" to all of them (

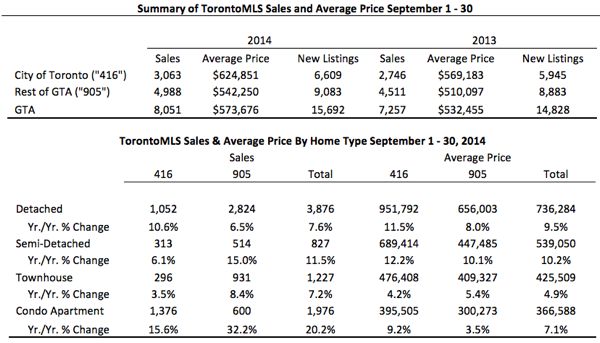

Back in August I wrote about the sellers who received 7 competing offers on offer-night, and said "no" to all of them ( Following is TREB’s market report for September 2014:

Following is TREB’s market report for September 2014:

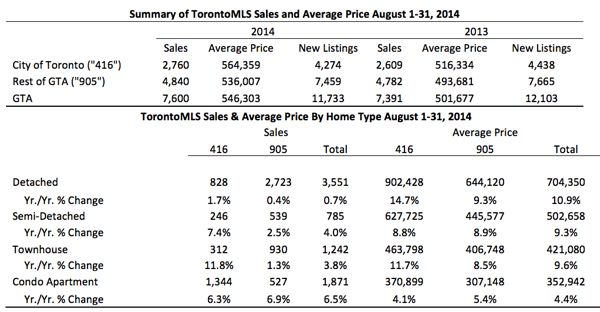

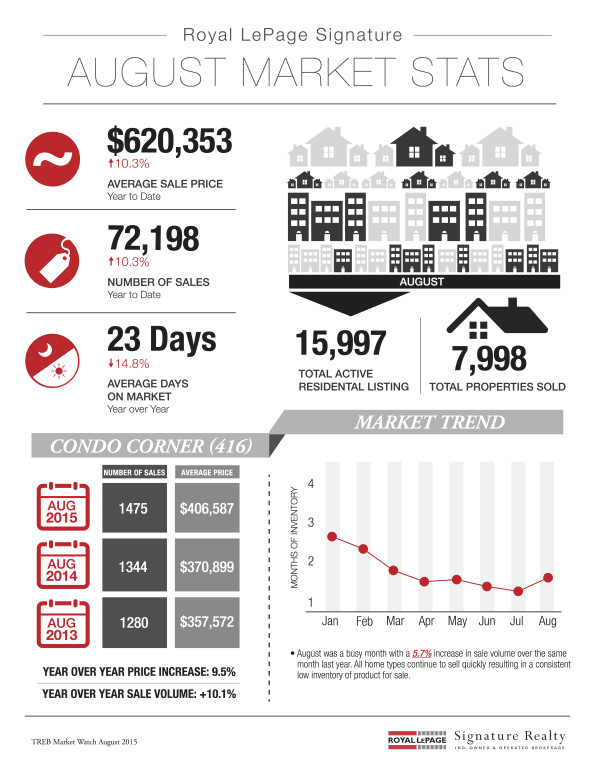

Following is TREB’s market report for August 2014:

Following is TREB’s market report for August 2014: