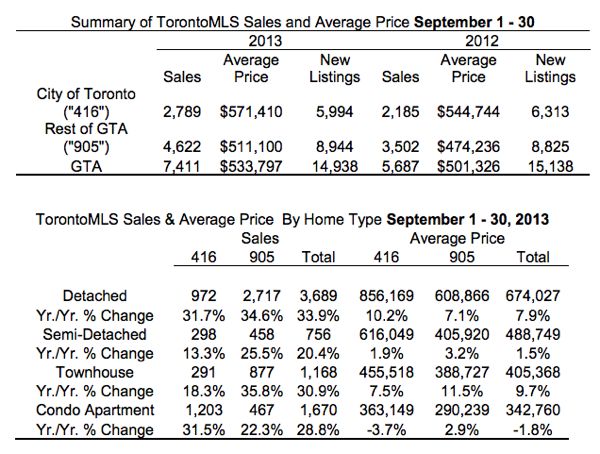

Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.

Following is TREB’s market report for September 2013: The Greater Toronto Area REALTORS® reported 7,411 residential sales through the TorontoMLS system in September 2013, representing a 30 per cent increase compared to 5,687 transactions reported in September 2012.

Year-to-date, total residential sales reported through TorontoMLS amounted to 68,907 during the first nine months of 2013 – down by one per cent compared to the same period in 2012.

“It’s great news that households have found that the costs of home ownership, including mortgage payments, remain affordable. This is why the third quarter was characterized by renewed growth in home sales in the GTA. We expect to see sales up for the remainder of 2013, as the pent-up demand that resulted from stricter mortgage lending guidelines continues to be satisfied,” said Toronto Real Estate Board President Dianne Usher.

The average selling price for September transactions was $533,797 – up by 6.5 per cent year-over-year.

Through the first three quarters of 2013, the average selling price was $520,118 – up by over four per cent compared to the first nine months of 2012.

The MLS® Home Price Index composite benchmark for September was up by four per cent year-over-year.

The annual rate of growth for the composite benchmark has been accelerating since the spring of 2013.

“The price growth story in September continued to be about strong demand for low-rise home types, coupled with a short supply of listings. Even with slower price growth and month-to-month volatility in the condo apartment market, overall annual price growth has been well above the rate of inflation this year. This scenario will continue to play out through the remainder of 2013,” said Jason Mercer, TREB’s Senior Manager of Market Analysis.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

For complete copies of TREB’s Monthly Market Watch Reports, visit my archives here.

t

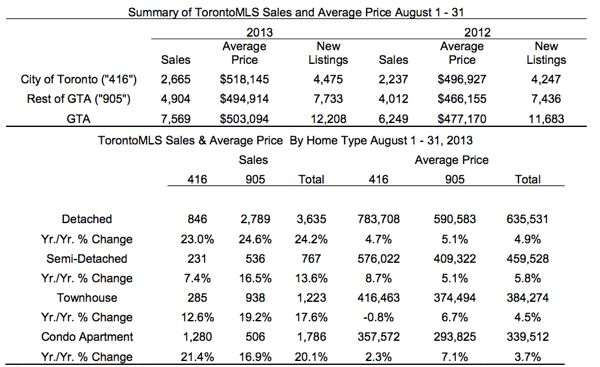

Following is TREB’s market report for August 2013: Greater Toronto Area REALTORS® reported 7,569 residential transactions through the TorontoMLS system in August 2013. This represented a 21 per cent increase compared to 6,249 sales in August 2012.

t

Following is TREB’s market report for August 2013: Greater Toronto Area REALTORS® reported 7,569 residential transactions through the TorontoMLS system in August 2013. This represented a 21 per cent increase compared to 6,249 sales in August 2012.

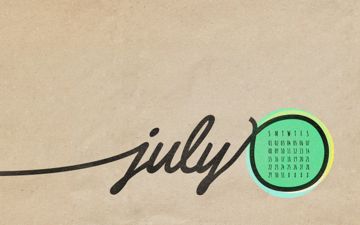

Following is TREB’s market report for July 2013: Greater Toronto Area REALTORS® reported 8,544 residential sales through the TorontoMLS system in July 2013. Total sales were up by 16 per cent compared to July 2012. Over the same period, new listings added to TorontoMLS and active listings at the end of the month were up, but by a substantially smaller rate of increase compared to sales.

Following is TREB’s market report for July 2013: Greater Toronto Area REALTORS® reported 8,544 residential sales through the TorontoMLS system in July 2013. Total sales were up by 16 per cent compared to July 2012. Over the same period, new listings added to TorontoMLS and active listings at the end of the month were up, but by a substantially smaller rate of increase compared to sales.

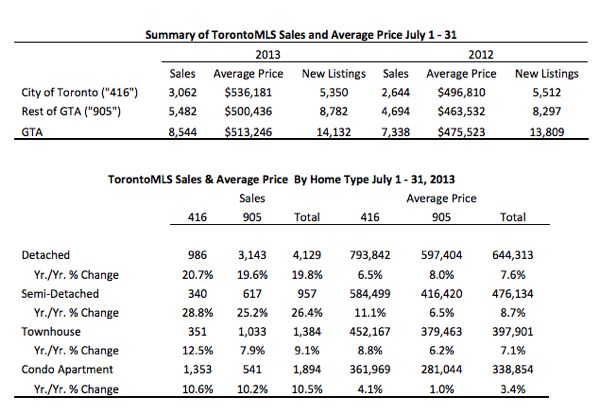

Following is TREB’s market report for June 2013: Greater Toronto Area REALTORS® reported 9,061 sales through the TorontoMLS system in June 2013 – down by less than one per cent compared to June 2012. Over the same period, new listings were down by a greater rate than sales, suggesting market conditions became tighter.

Following is TREB’s market report for June 2013: Greater Toronto Area REALTORS® reported 9,061 sales through the TorontoMLS system in June 2013 – down by less than one per cent compared to June 2012. Over the same period, new listings were down by a greater rate than sales, suggesting market conditions became tighter.

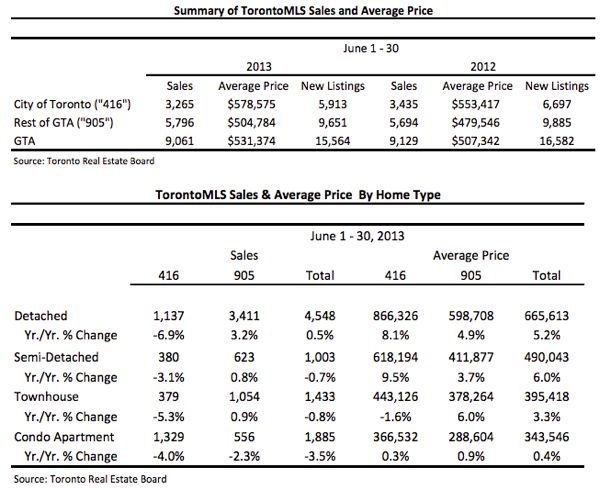

Following is TREB’s market report for May 2013: Greater Toronto Area (GTA) REALTORS® reported 10,182 sales through the TorontoMLS system in May 2013, representing a dip of 3.4 per cent compared to May 2012.

Following is TREB’s market report for May 2013: Greater Toronto Area (GTA) REALTORS® reported 10,182 sales through the TorontoMLS system in May 2013, representing a dip of 3.4 per cent compared to May 2012.

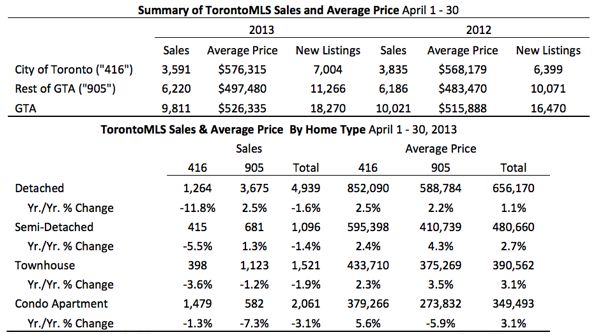

Following is TREB’s market report for April 2013: Greater Toronto Area REALTORS® reported 9,811 sales through the TorontoMLS system in April 2013, representing a dip of two per cent in comparison to 10,021 transactions in April 2012. Both new listings during the month and active listings at the end of April were up on a year-over-year basis.

Following is TREB’s market report for April 2013: Greater Toronto Area REALTORS® reported 9,811 sales through the TorontoMLS system in April 2013, representing a dip of two per cent in comparison to 10,021 transactions in April 2012. Both new listings during the month and active listings at the end of April were up on a year-over-year basis.

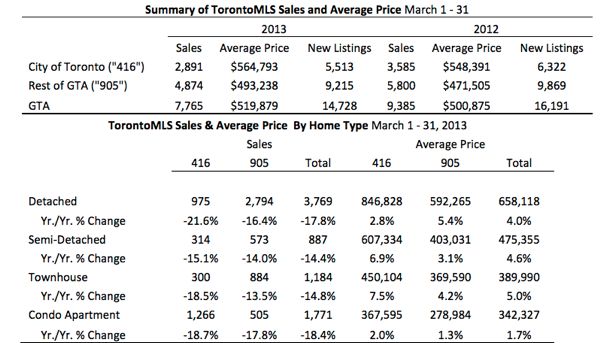

Following is TREB’s market report for March 2013: Greater Toronto Area REALTORS® reported 7,765 transactions through the TorontoMLS system in March 2013 – down 17 per cent compared to 9,385 transactions in March 2012.

Following is TREB’s market report for March 2013: Greater Toronto Area REALTORS® reported 7,765 transactions through the TorontoMLS system in March 2013 – down 17 per cent compared to 9,385 transactions in March 2012.

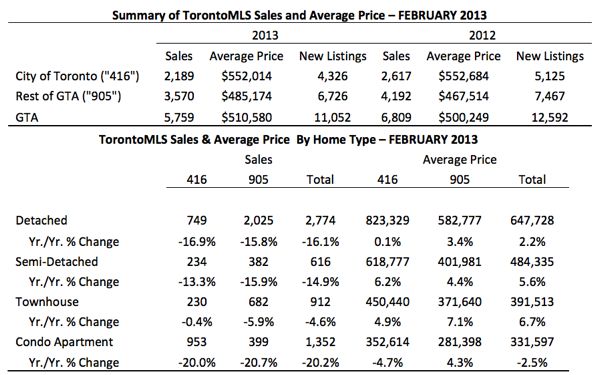

Following is TREB’s market report for February 2013: Greater Toronto Area (GTA) REALTORS® reported 5,759 sales through the TorontoMLS system in February 2013 – a decline of 15 per cent in comparison to February 2012. It should be noted that 2012 was a leap year with one extra day in February. A 28 day year-over-year sales comparison resulted in a lesser decline of 10.5 per cent.

Following is TREB’s market report for February 2013: Greater Toronto Area (GTA) REALTORS® reported 5,759 sales through the TorontoMLS system in February 2013 – a decline of 15 per cent in comparison to February 2012. It should be noted that 2012 was a leap year with one extra day in February. A 28 day year-over-year sales comparison resulted in a lesser decline of 10.5 per cent.

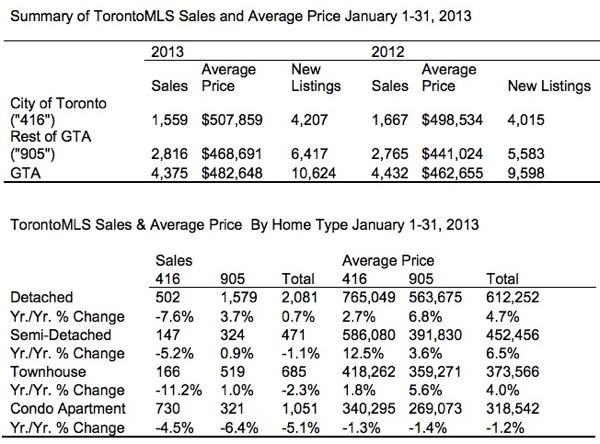

Following is TREB’s market report for January 2013: Greater Toronto Area REALTORS® reported 4,375 transactions through the TorontoMLS system in January 2013. This number represented a slight decline compared to 4,432 transactions reported in January 2012.

Following is TREB’s market report for January 2013: Greater Toronto Area REALTORS® reported 4,375 transactions through the TorontoMLS system in January 2013. This number represented a slight decline compared to 4,432 transactions reported in January 2012.

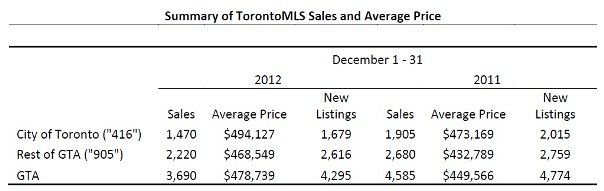

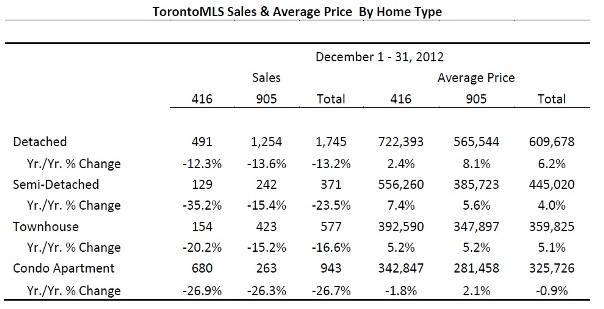

Following is TREB’s market report for December 2012: Greater Toronto Area REALTORS® reported 3,690 sales through the TorontoMLS system in December 2012 – down from 4,585 sales in December 2011. Total sales for 2012 amounted to 85,731 – down from 89,096 transactions in 2011.

Following is TREB’s market report for December 2012: Greater Toronto Area REALTORS® reported 3,690 sales through the TorontoMLS system in December 2012 – down from 4,585 sales in December 2011. Total sales for 2012 amounted to 85,731 – down from 89,096 transactions in 2011.

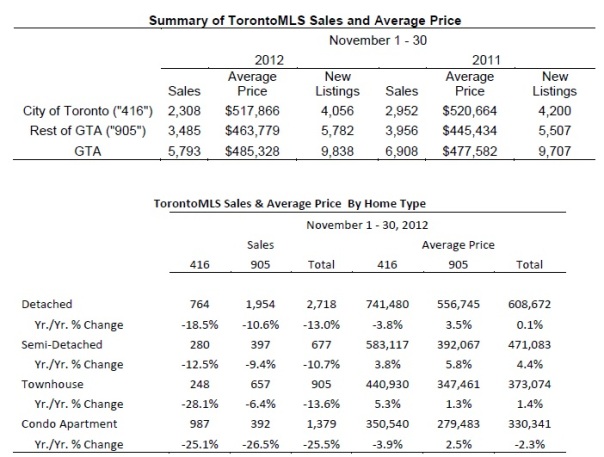

Following is TREB’s market report for November 2012: Toronto Area REALTORS® reported 5,793 sales in November 2012 – down by 16 per cent compared to November 2011.

Following is TREB’s market report for November 2012: Toronto Area REALTORS® reported 5,793 sales in November 2012 – down by 16 per cent compared to November 2011.

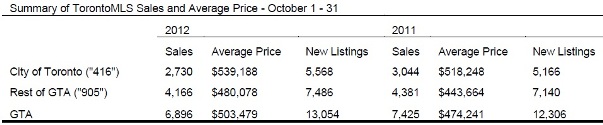

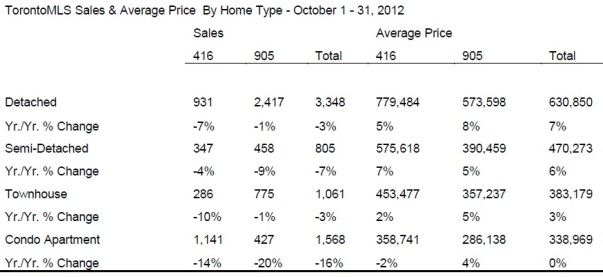

Following is TREB’s market report for October 2012: Greater Toronto Area REALTORS® reported 6,896 transactions through the TorontoMLS system in October 2012 – a decrease of 7.1 per cent compared to October 2011. There were two more business days in October 2012 versus October 2011. On a per business day basis, transactions were down by 15.6 per cent.*

Following is TREB’s market report for October 2012: Greater Toronto Area REALTORS® reported 6,896 transactions through the TorontoMLS system in October 2012 – a decrease of 7.1 per cent compared to October 2011. There were two more business days in October 2012 versus October 2011. On a per business day basis, transactions were down by 15.6 per cent.*

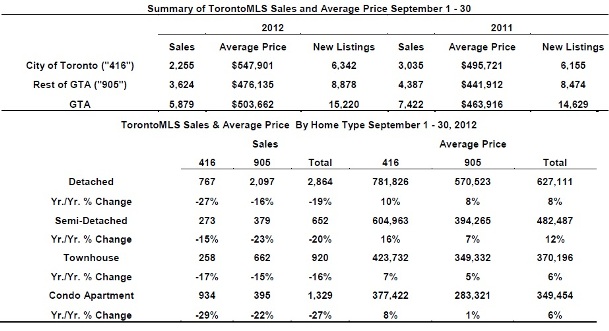

Following is TREB’s market report for September 2012: Greater Toronto Area (GTA) REALTORS® reported 5,879 transactions through the TorontoMLS system in September 2012. The average selling price for these transactions was $503,662, representing an increase of more than 8.5 per cent compared to last year.

Following is TREB’s market report for September 2012: Greater Toronto Area (GTA) REALTORS® reported 5,879 transactions through the TorontoMLS system in September 2012. The average selling price for these transactions was $503,662, representing an increase of more than 8.5 per cent compared to last year.

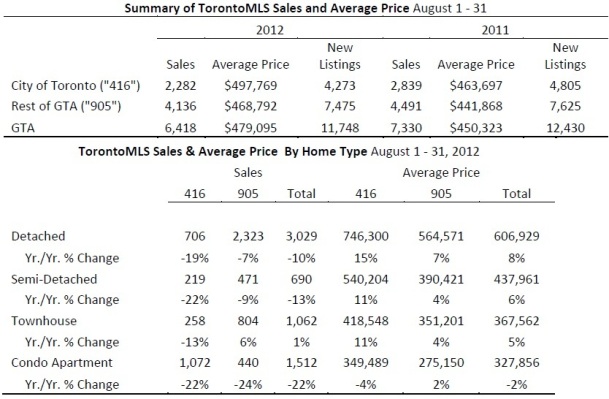

Following is TREB’s market report for August 2012: Greater Toronto Area (GTA) REALTORS® reported 6,418 sales through the TorontoMLS system in August 2012, representing a year-over-decline of almost 12.5 per cent compared to 7,330 sales reported in August 2011. The number of new listings reported in August was down by 5.5 per cent compared to the same period in 2011.

Following is TREB’s market report for August 2012: Greater Toronto Area (GTA) REALTORS® reported 6,418 sales through the TorontoMLS system in August 2012, representing a year-over-decline of almost 12.5 per cent compared to 7,330 sales reported in August 2011. The number of new listings reported in August was down by 5.5 per cent compared to the same period in 2011.

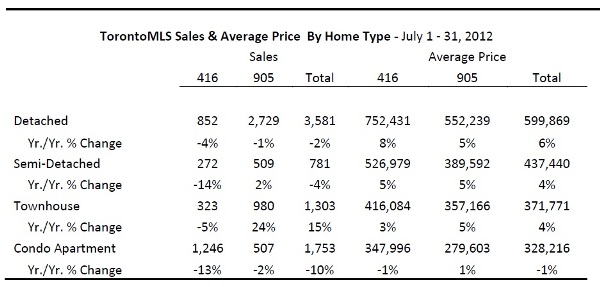

Following is TREB’s market report for July 2012: TORONTO, August 3, 2012 – Greater Toronto REALTORS® reported 7,570 sales in July 2012, representing a decline of 1.5 per cent compared to 7,683 sales reported in July 2011. The decline was most pronounced in the condominium apartment segment in the City of Toronto. Total sales in the rest of the Greater Toronto Area (GTA) were up compared to the same period last year.

Following is TREB’s market report for July 2012: TORONTO, August 3, 2012 – Greater Toronto REALTORS® reported 7,570 sales in July 2012, representing a decline of 1.5 per cent compared to 7,683 sales reported in July 2011. The decline was most pronounced in the condominium apartment segment in the City of Toronto. Total sales in the rest of the Greater Toronto Area (GTA) were up compared to the same period last year.

Following is TREB’s market report for June 2012: Greater Toronto REALTORS® reported 9,422 home sales through the TorontoMLS system in June 2012. The number of transactions was down by 5.4 per cent in comparison to June 2011. The year-over-year decline was largest in the City of Toronto, where sales were down by 13 per cent compared to June 2011. Sales in the rest of the Toronto Real Estate Board (TREB) market area were comparable to a year ago.

Following is TREB’s market report for June 2012: Greater Toronto REALTORS® reported 9,422 home sales through the TorontoMLS system in June 2012. The number of transactions was down by 5.4 per cent in comparison to June 2011. The year-over-year decline was largest in the City of Toronto, where sales were down by 13 per cent compared to June 2011. Sales in the rest of the Toronto Real Estate Board (TREB) market area were comparable to a year ago.

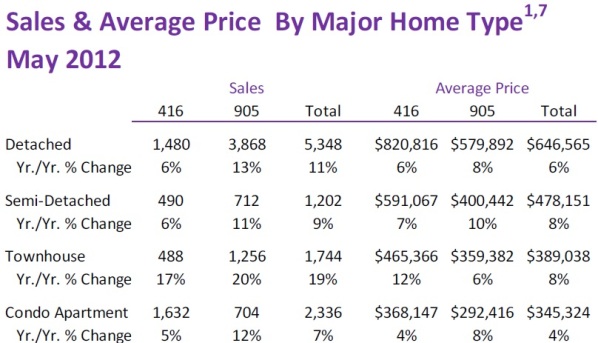

Following is TREB’s market report for May 2012: Greater Toronto REALTORS® reported 10,850 transactions through the TorontoMLS system in May 2012 – an 11 per cent increase over the 9,766 sales in May 2011. Sales growth was strongest in the ‘905’ regions surrounding the City of Toronto.

Following is TREB’s market report for May 2012: Greater Toronto REALTORS® reported 10,850 transactions through the TorontoMLS system in May 2012 – an 11 per cent increase over the 9,766 sales in May 2011. Sales growth was strongest in the ‘905’ regions surrounding the City of Toronto.

Following is TREB’s market report for April 2012: Greater Toronto REALTORS® reported 10,350 transactions through the TorontoMLS system in April 2012. This level of sales was 18 per cent higher than the 8,778 firm deals reported in April 2011. The strongest sales growth was reported in the single-detached market segment, with transactions of this home type up by 22 per cent compared to a year ago.

Following is TREB’s market report for April 2012: Greater Toronto REALTORS® reported 10,350 transactions through the TorontoMLS system in April 2012. This level of sales was 18 per cent higher than the 8,778 firm deals reported in April 2011. The strongest sales growth was reported in the single-detached market segment, with transactions of this home type up by 22 per cent compared to a year ago.

If you’re thinking of making a move and would like to know how I can help, feel free to

If you’re thinking of making a move and would like to know how I can help, feel free to  Following is TREB’s market report for March 2012: Greater Toronto REALTORS® reported 9,690 sales through the TorontoMLS System in March 2012. This result was up by almost eight per cent in comparison to the 8,986 deals reported during the same period in 2011.

Following is TREB’s market report for March 2012: Greater Toronto REALTORS® reported 9,690 sales through the TorontoMLS System in March 2012. This result was up by almost eight per cent in comparison to the 8,986 deals reported during the same period in 2011.

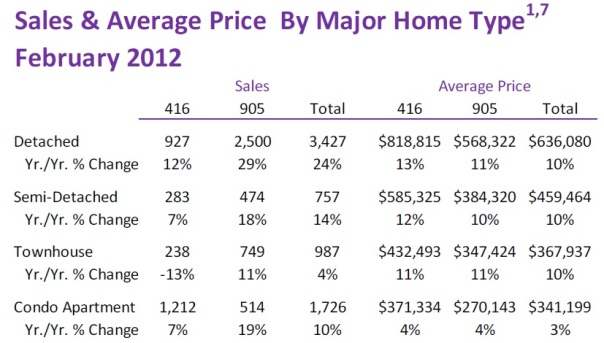

Following is TREB’s market report for Febuary 2012: Greater Toronto REALTORS® reported 7,032 sales in February 2012 – up 16 per cent compared to February 2011. New listings were also up over the same period, but by a lesser 11 per cent to 12,684. It is important to note that 2012 is a leap year, with one more day in February. Over the first 28 days of February, sales and new listings were up by ten per cent and six per cent respectively.

Following is TREB’s market report for Febuary 2012: Greater Toronto REALTORS® reported 7,032 sales in February 2012 – up 16 per cent compared to February 2011. New listings were also up over the same period, but by a lesser 11 per cent to 12,684. It is important to note that 2012 is a leap year, with one more day in February. Over the first 28 days of February, sales and new listings were up by ten per cent and six per cent respectively.