In a previous blog post (read it here) I explored some of the unique factors involved when selling one property and buying another at the same time. I touched briefly on market conditions, budgetary concerns, and the best way to avoid being pressured into making a purchase you’re not completely happy with. There's one more factor I'd like to take a look at - Timing.

Part of my job as a Realtor is to help clients time the closings of their purchases and sales as perfectly as possible. If you're buying and selling at the same time, you'll ideally want to take possession of your new home a few days prior to giving up possession on your old one. This way, you've got a few days' overlap with both properties. This allows for a bit of breathing room with regards to booking movers, switching over telephone and internet connections, etc.

However, it's not always possible to line up the closings as closely as we'd like. In anticipation of this possibility I ask my clients, "Would you rather have two homes for a few weeks or no home for a few weeks?"

Having two homes for a few weeks can be an issue as most buyers rely on the proceeds from the sale of one home to go towards the purchase of another. Thankfully, bridge financing can help to "bridge" this gap. Of course, bridge financing can only be obtained if there's a firm sale on the purchaser's property...

Having no home for a few weeks is obviously going to be much more of an issue for the majority of buyers. Sure, there's the possibility of a short term rental during the interim. But who wants to move everything into the rental and then turn around and move again shortly after? I have seen people do it though - especially if their dream home comes along and they don't want to risk it passing them by.

If my clients and I anticipate that timing the closings may be an issue, I include a clause in the agreement that allows them the power to either move up or extend the closing date if they need to. This doesn't always fly though - it depends largely on the other party's own particular situation and what kind of leverage position my clients are in.

Ultimately, "Should I buy first or should I sell first?" is a question without an easy answer. Each situation is different from the next and the same strategy isn't going to work for every buyer/seller. Be sure to consult your realtor for advice on how best to proceed.

If you’re thinking of making a move and would like to know how we can help, please contact me for more info.

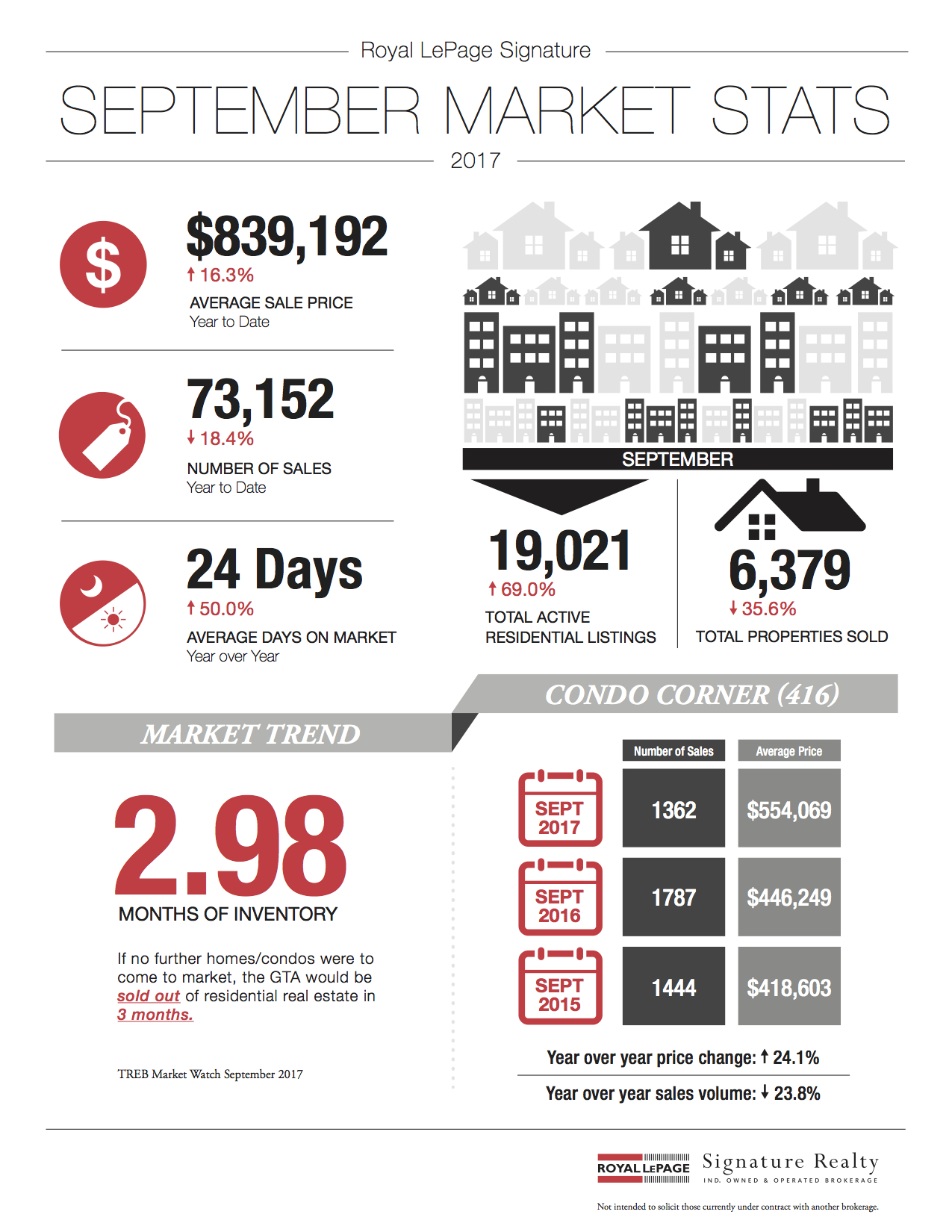

September 2017 market stats are here!

September 2017 market stats are here! Welcome to the leafy green streets of beautiful Roncesvalles!

Welcome to the leafy green streets of beautiful Roncesvalles!

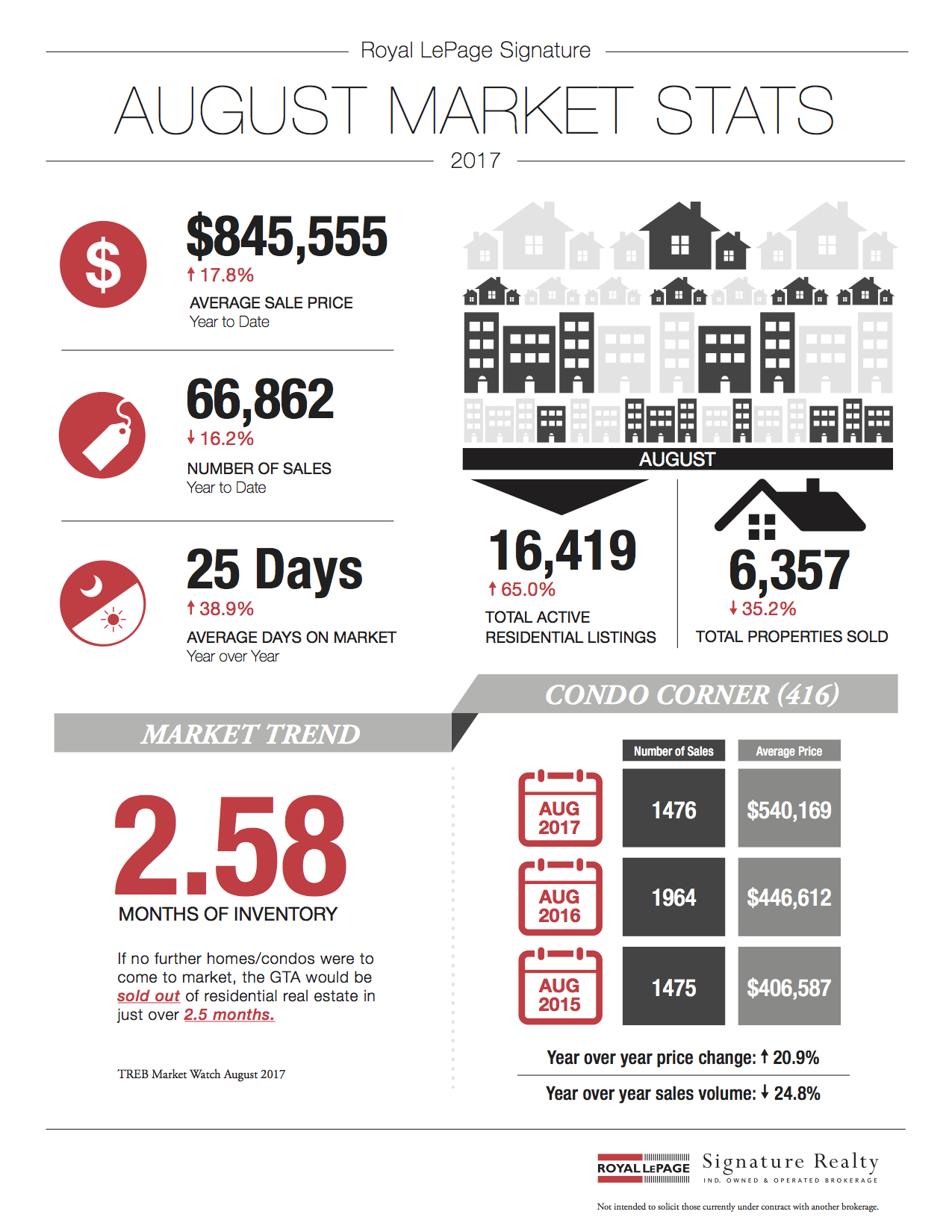

Following is TREB’s market report for August 2017:

Following is TREB’s market report for August 2017: