September 2017 market stats are here!

September 2017 market stats are here!

The average sale price for the month was $775,546, up 2.6% over September 2016.

Here's a breakdown of the average sale prices & year-over-year increases for the 416 area code:

- Detached = $1,355,234 (+4.4%)

- Semi-Detached = $935,467 (+5.2%)

- Townhouse = $685,016 (+4.8%)

- Condo Apartment = $554,069 (+24.0%)

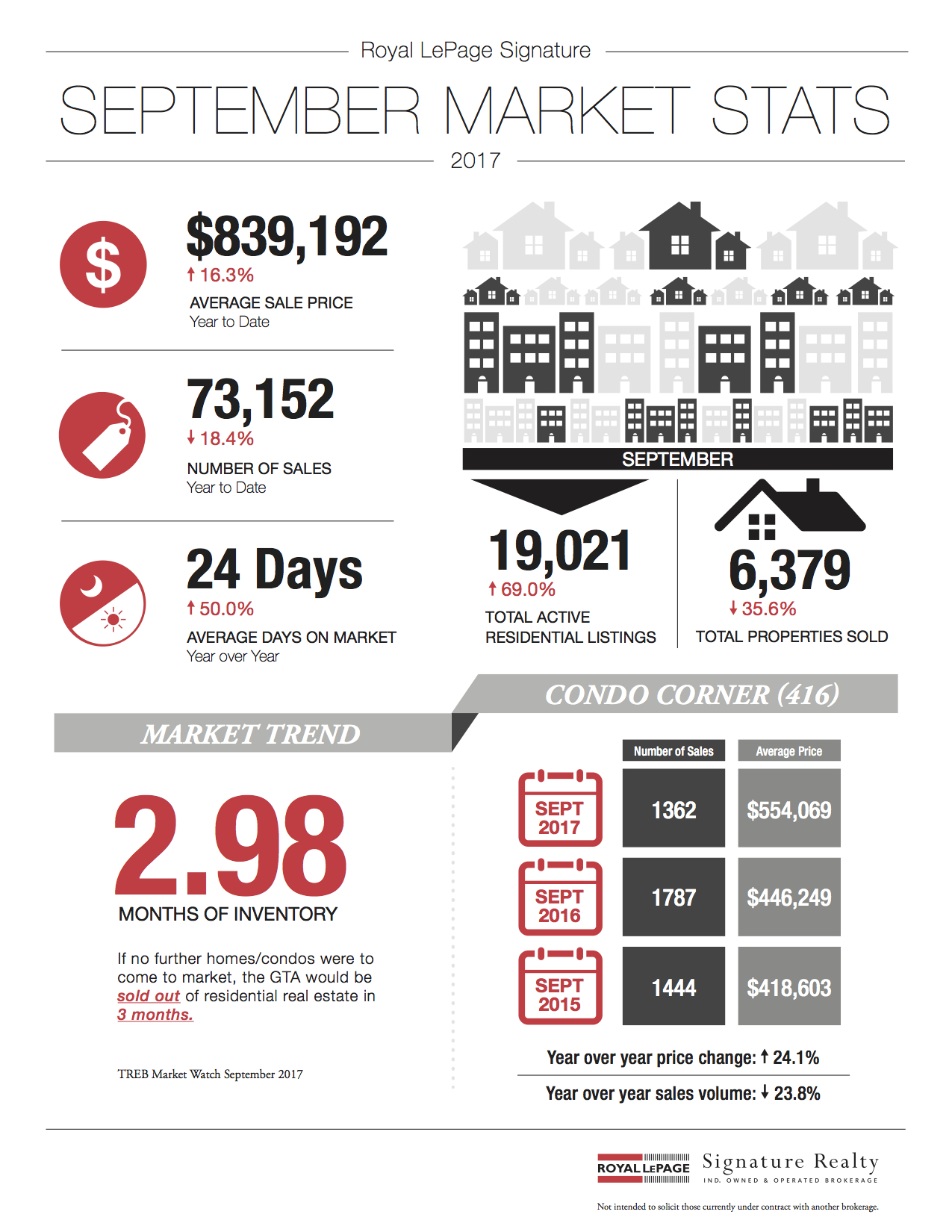

And here's TREB’s official market report for the month September 2017:

Toronto Real Estate Board President Tim Syrianos announced that Greater Toronto Area REALTORS® reported 6,379 sales through TREB's MLS® System in September 2017. This result was down by 35 per cent compared to September 2016.

The number of new listings entered into TREB's MLS® System amounted to 16,469 in September – up by 9.4 per cent year-over-year.

"The improvement in listings in September compared to a year earlier suggests that home owners are anticipating an uptick in sales activity as we move through the fall. Consumer polling undertaken for TREB in the spring suggested that buying intentions over the next year remain strong. As we move through the fourth quarter we could see some buyers moving off the sidelines, taking advantage of a better-supplied marketplace," said Mr. Syrianos.

The average selling price in September 2017 was $775,546 – up 2.6 per cent compared to September 2016.

The MLS® Home Price Index (HPI) composite benchmark was up by 12.2 per cent on a year-over-year basis.

A key reason for the difference in annual growth rates between the average price and the MLS® HPI composite is the fact that detached homes – the most expensive market segment on average – accounted for a smaller share of overall transactions this year compared to last.

"With more balanced market conditions, the pace of year-over-year price growth was more moderate in September compared to a year ago. However, the exception was the condominium apartment market segment, where average and benchmark sales prices were up by more than 20 per cent compared to last year. Tighter market conditions for condominium apartments follows consumer polling results from the spring that pointed toward a shift to condos in terms of buyer intentions," said Jason Mercer, TREB's Director of Market Analysis.

If you’re thinking of making a move and would like to know how I can help, feel free to contact me for more info.

For complete copies of TREB’s Monthly Market Watch Reports, visit my archives here.

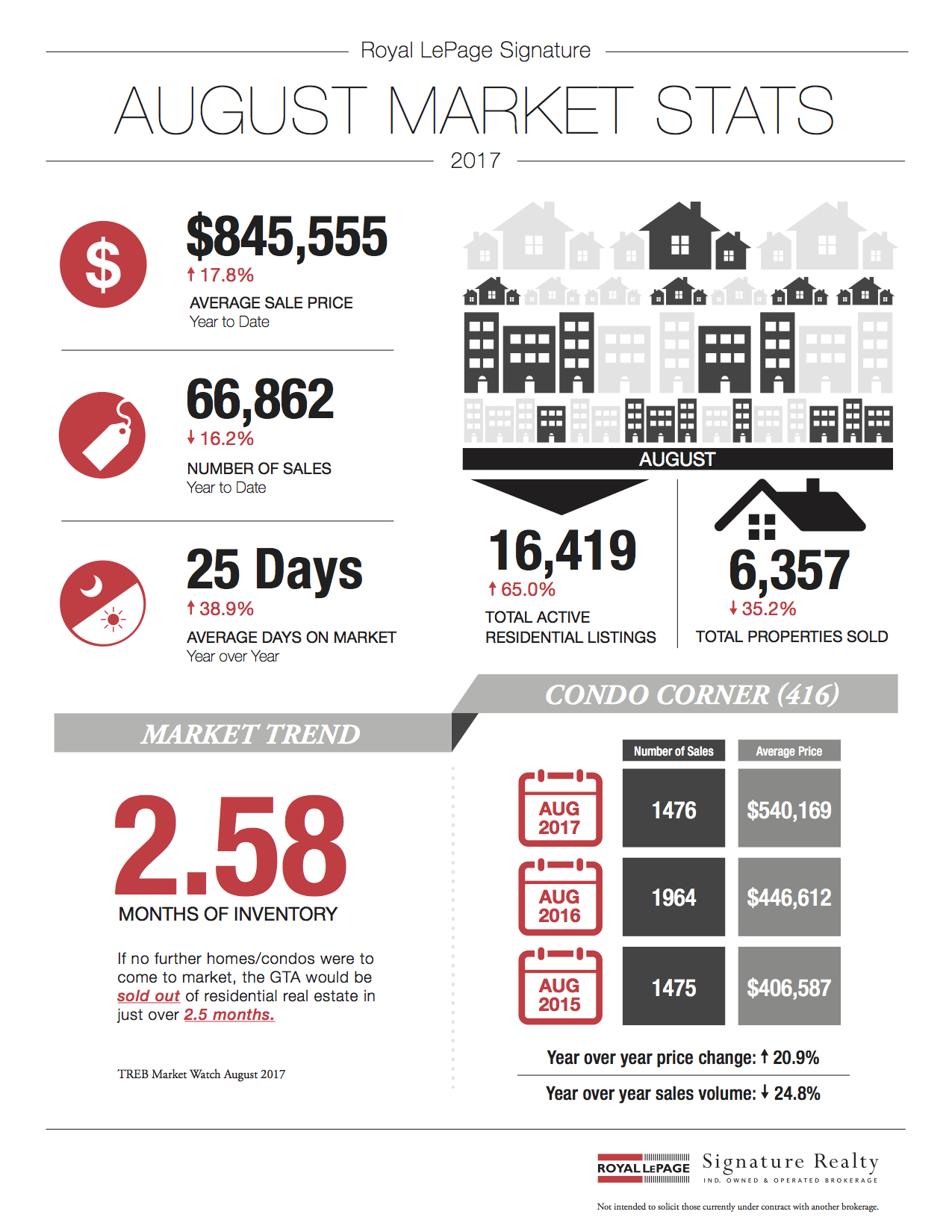

Following is TREB’s market report for August 2017:

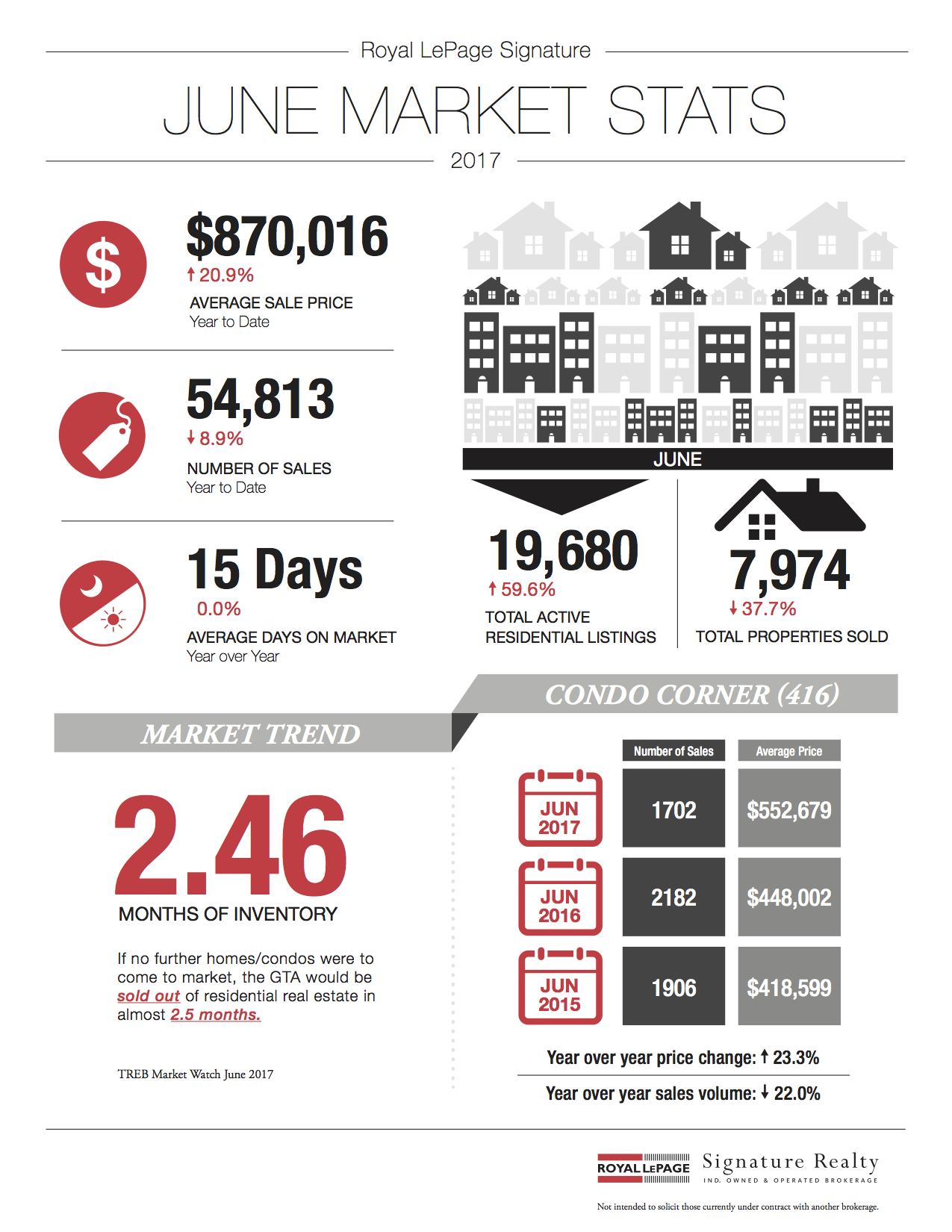

Following is TREB’s market report for August 2017: Following is TREB’s market report for June 2017:

Following is TREB’s market report for June 2017: Following is TREB’s market report for April 2017:

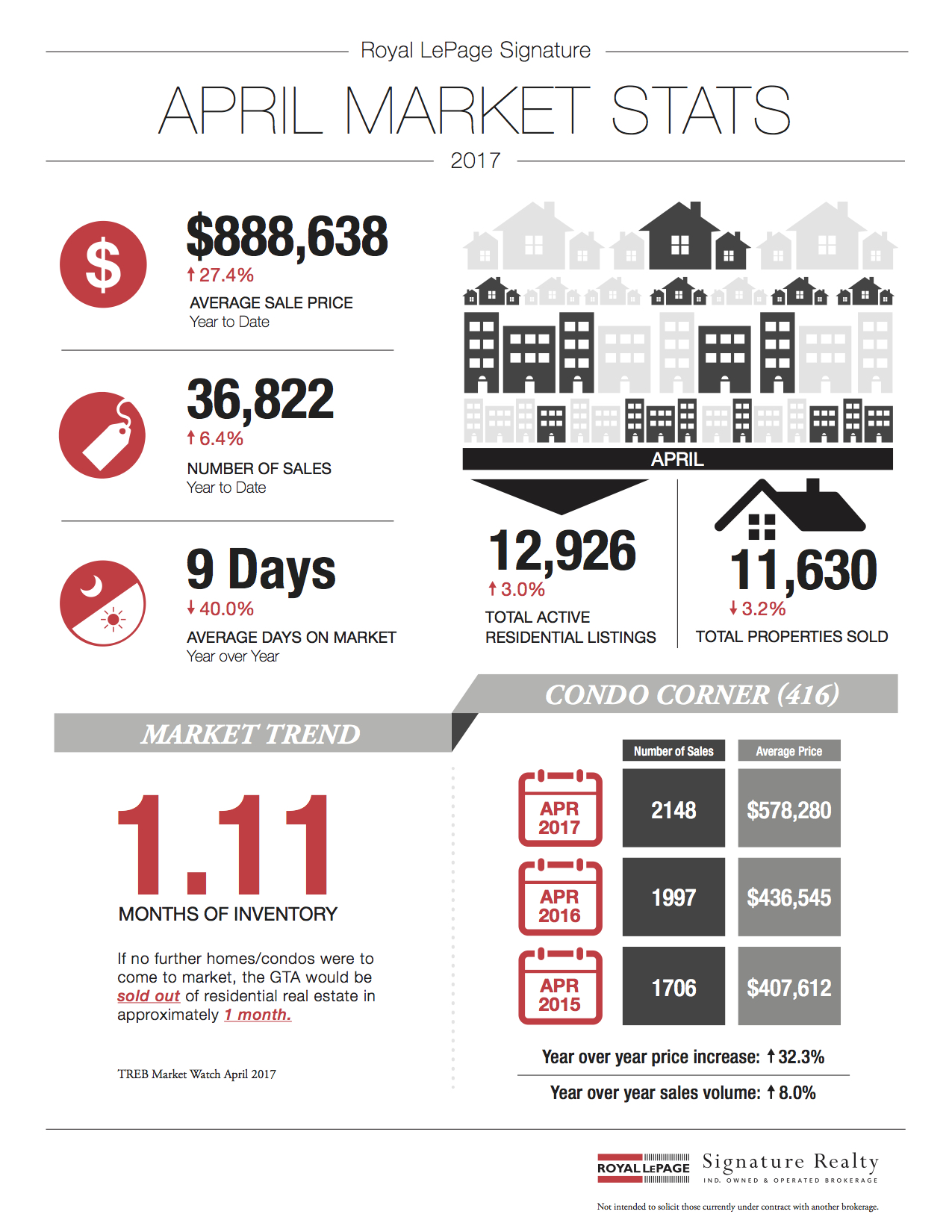

Following is TREB’s market report for April 2017:

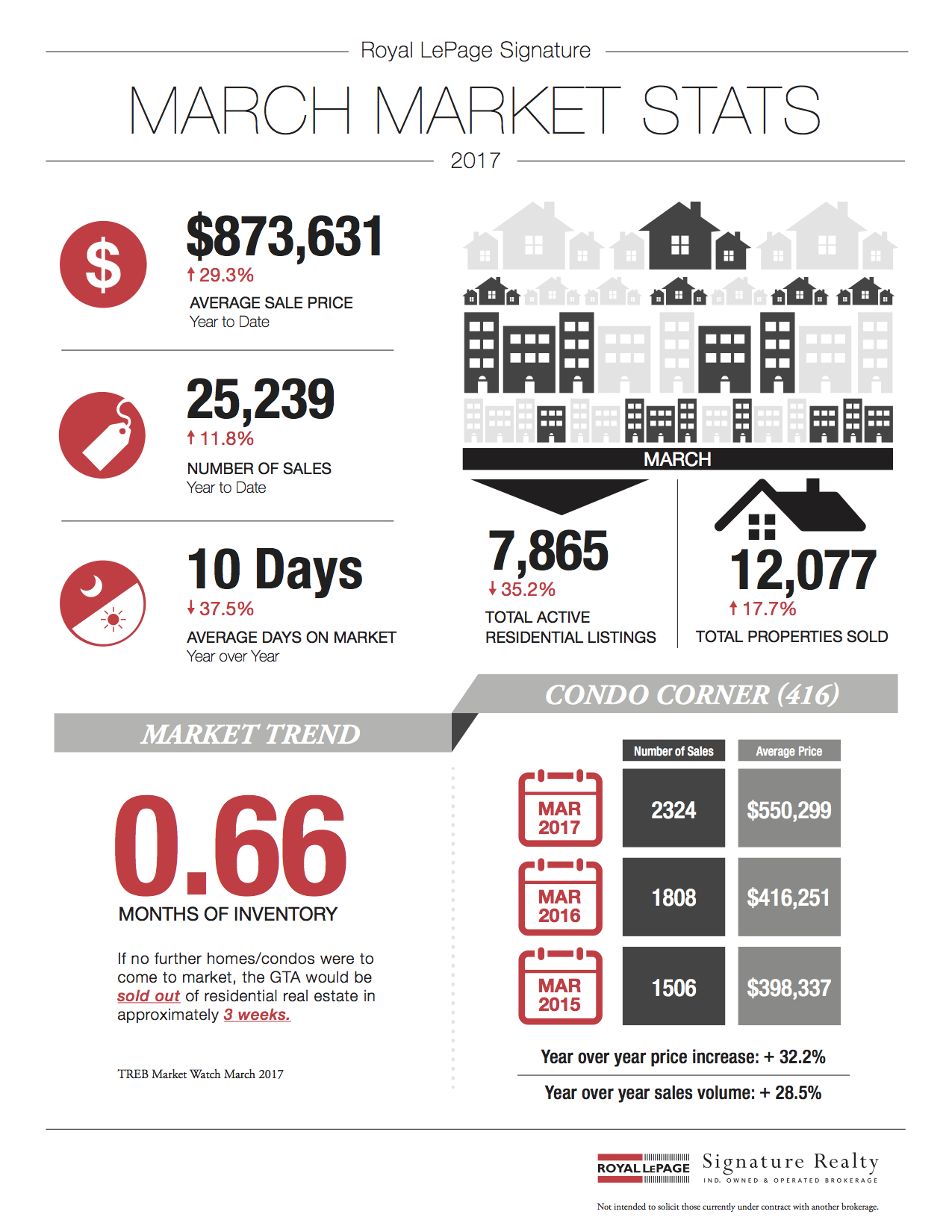

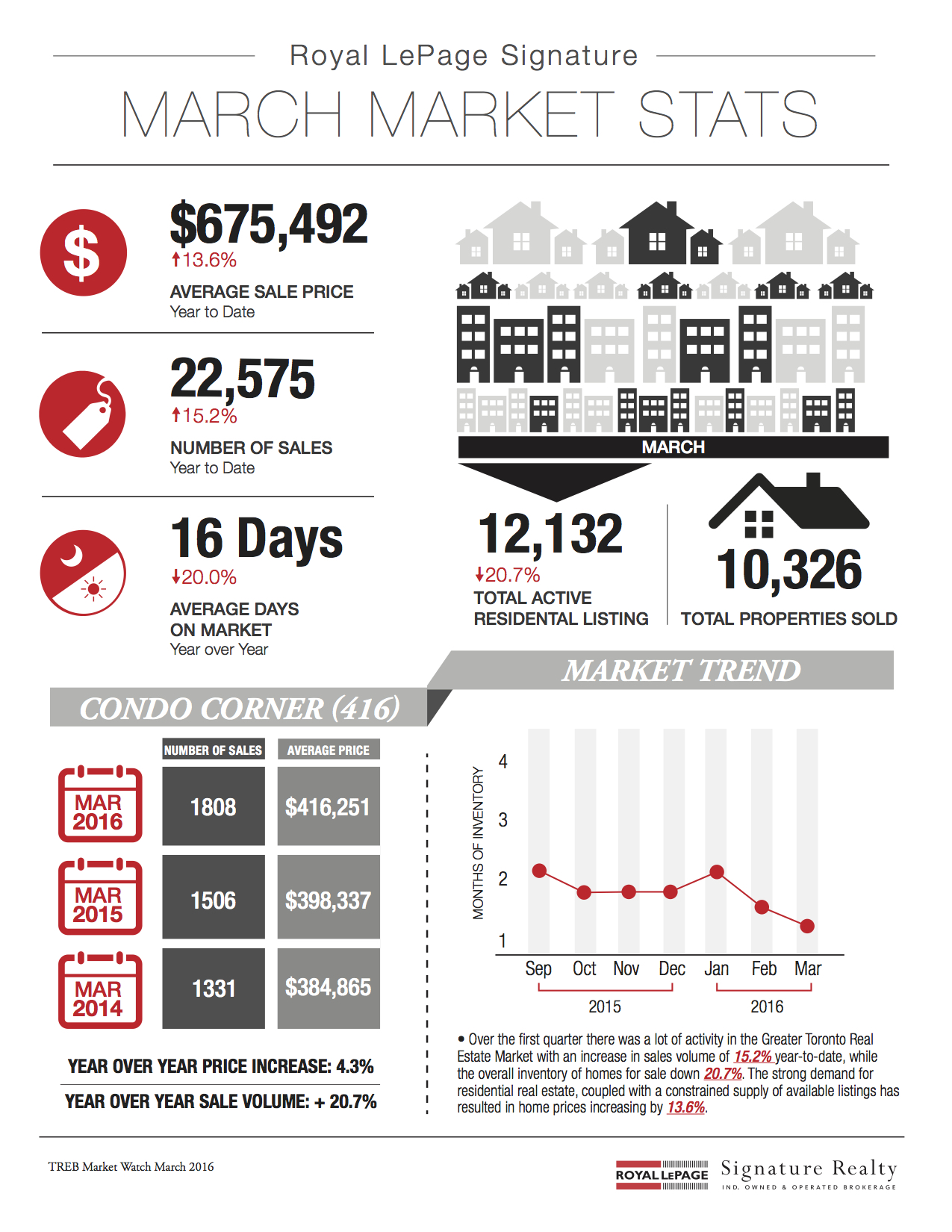

Following is TREB’s market report for March 2017:

Following is TREB’s market report for March 2017: Following is TREB’s market report for February 2017:

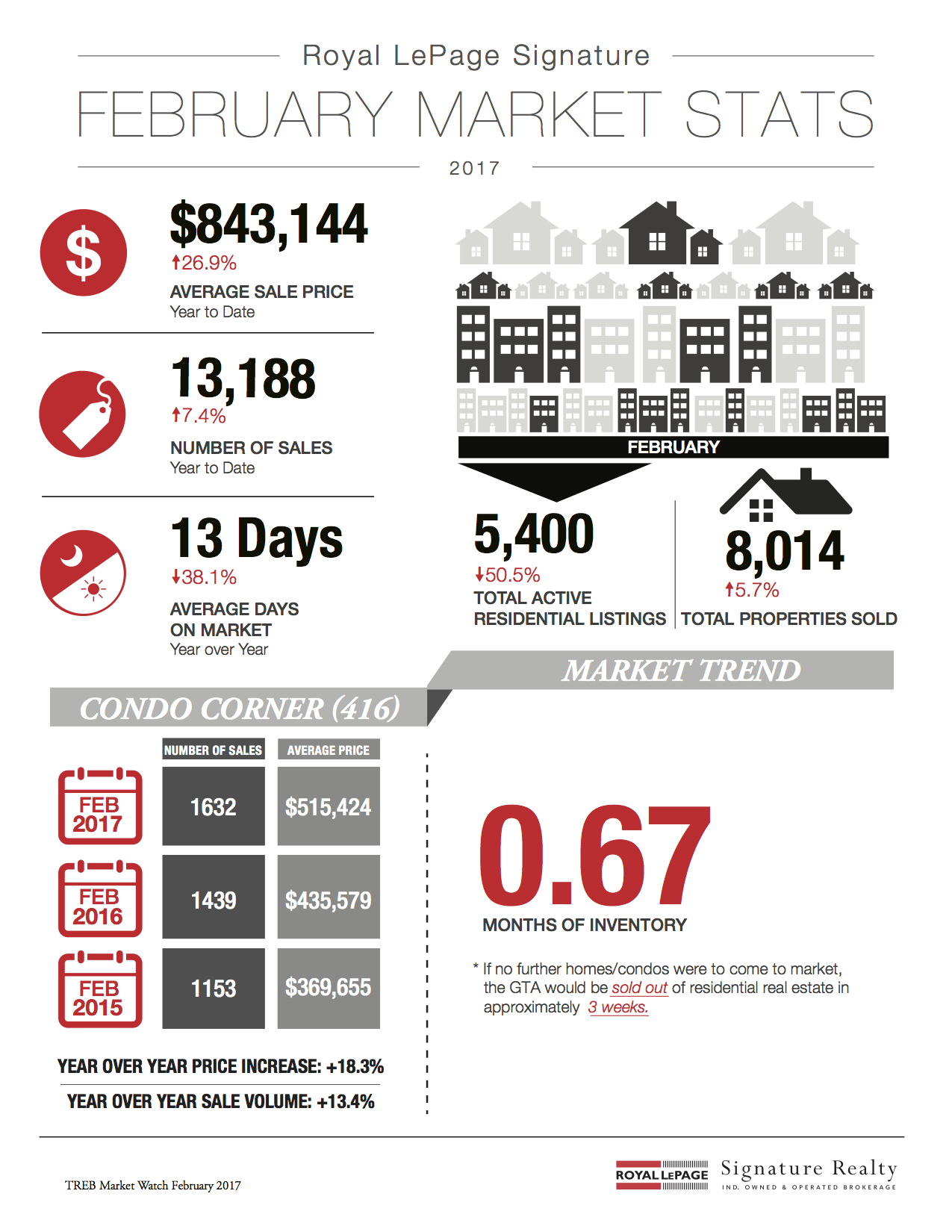

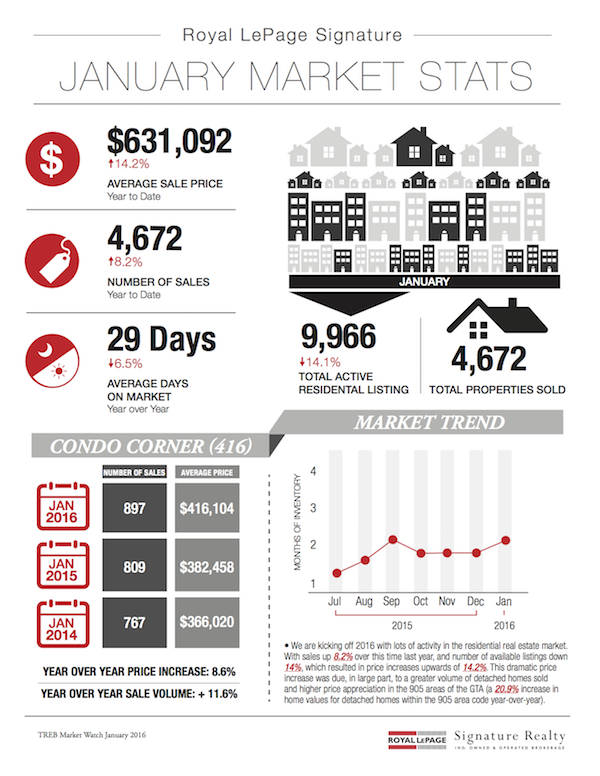

Following is TREB’s market report for February 2017: Following is TREB’s market report for January 2017:

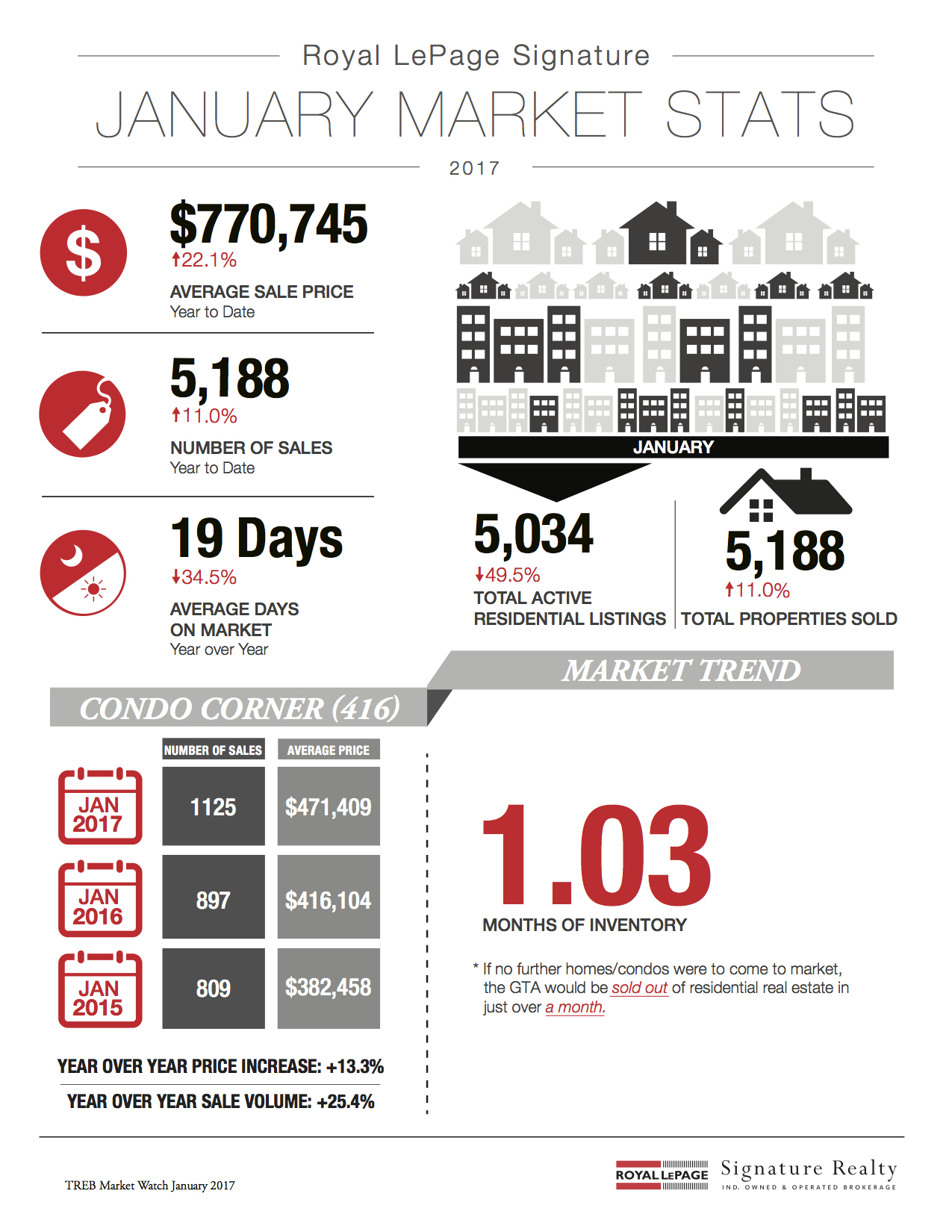

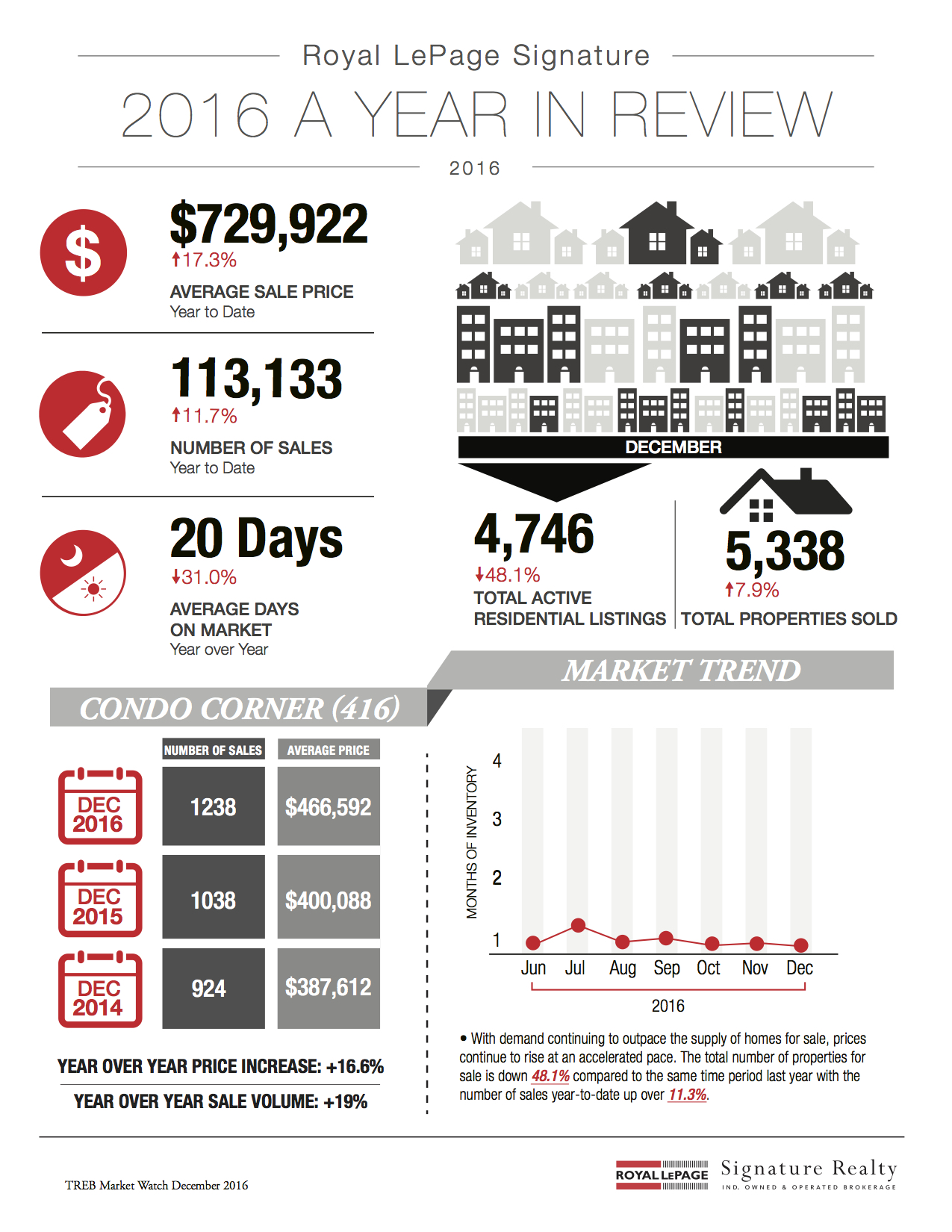

Following is TREB’s market report for January 2017: Following is TREB’s market report for the year 2016:

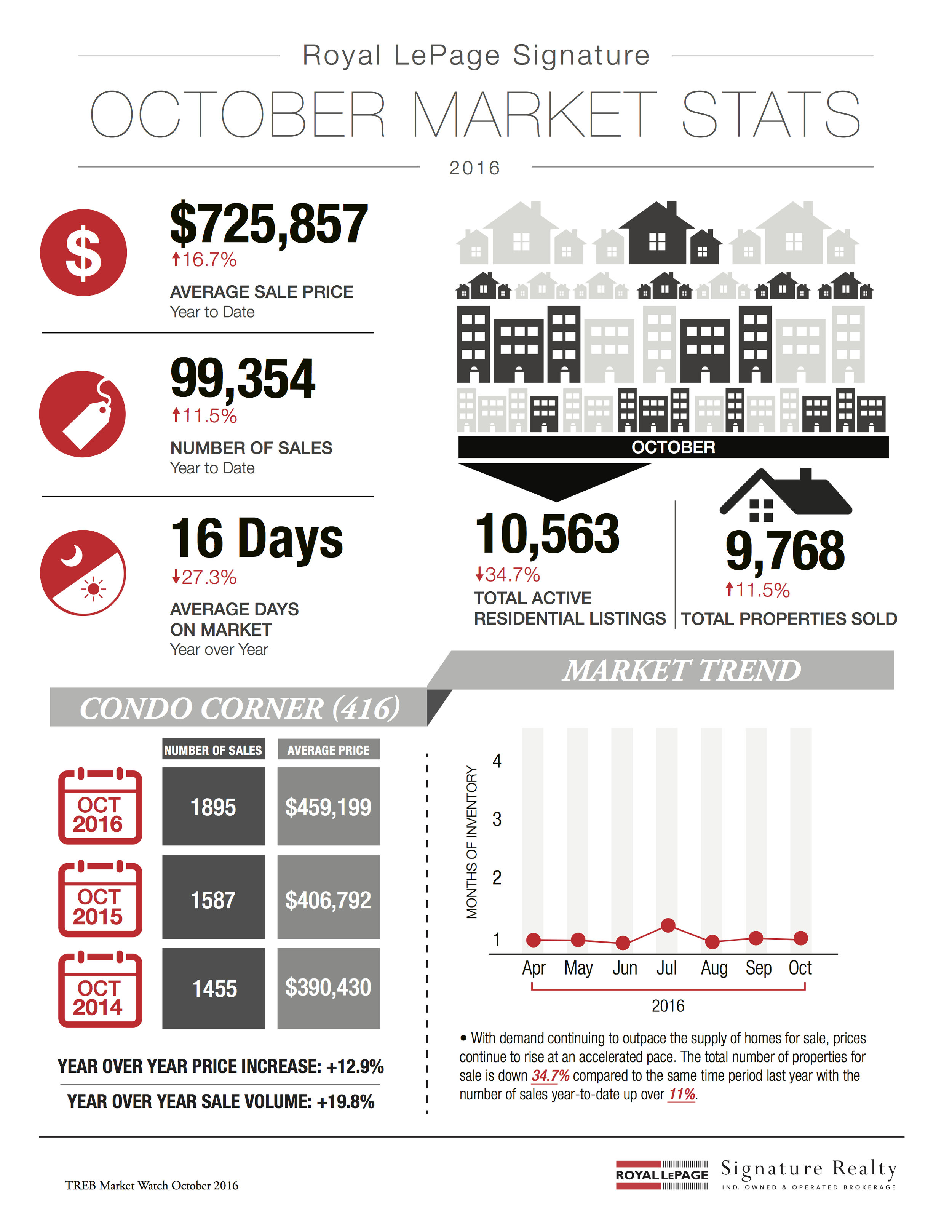

Following is TREB’s market report for the year 2016: Following is TREB’s market report for October 2016:

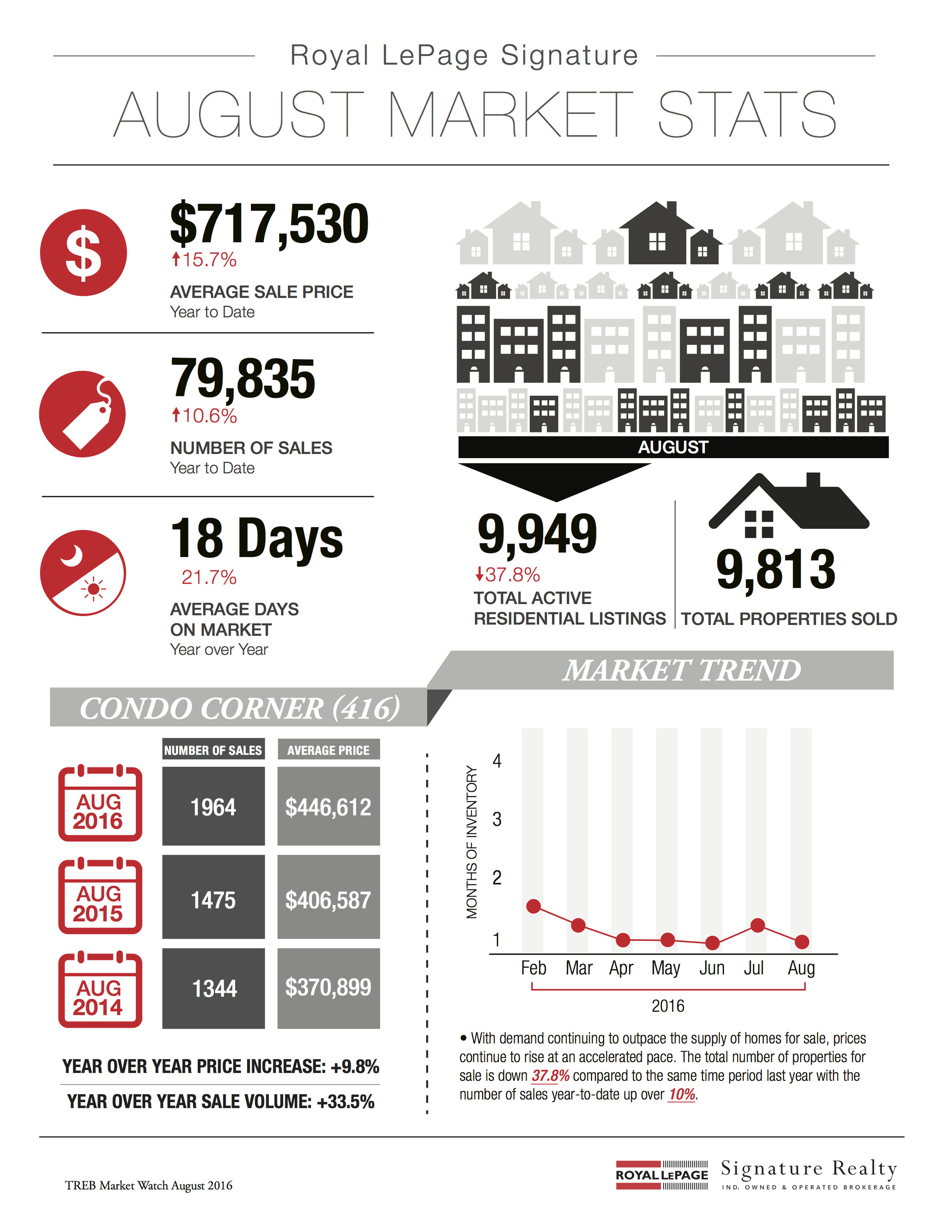

Following is TREB’s market report for October 2016: Following is TREB’s market report for August 2016:

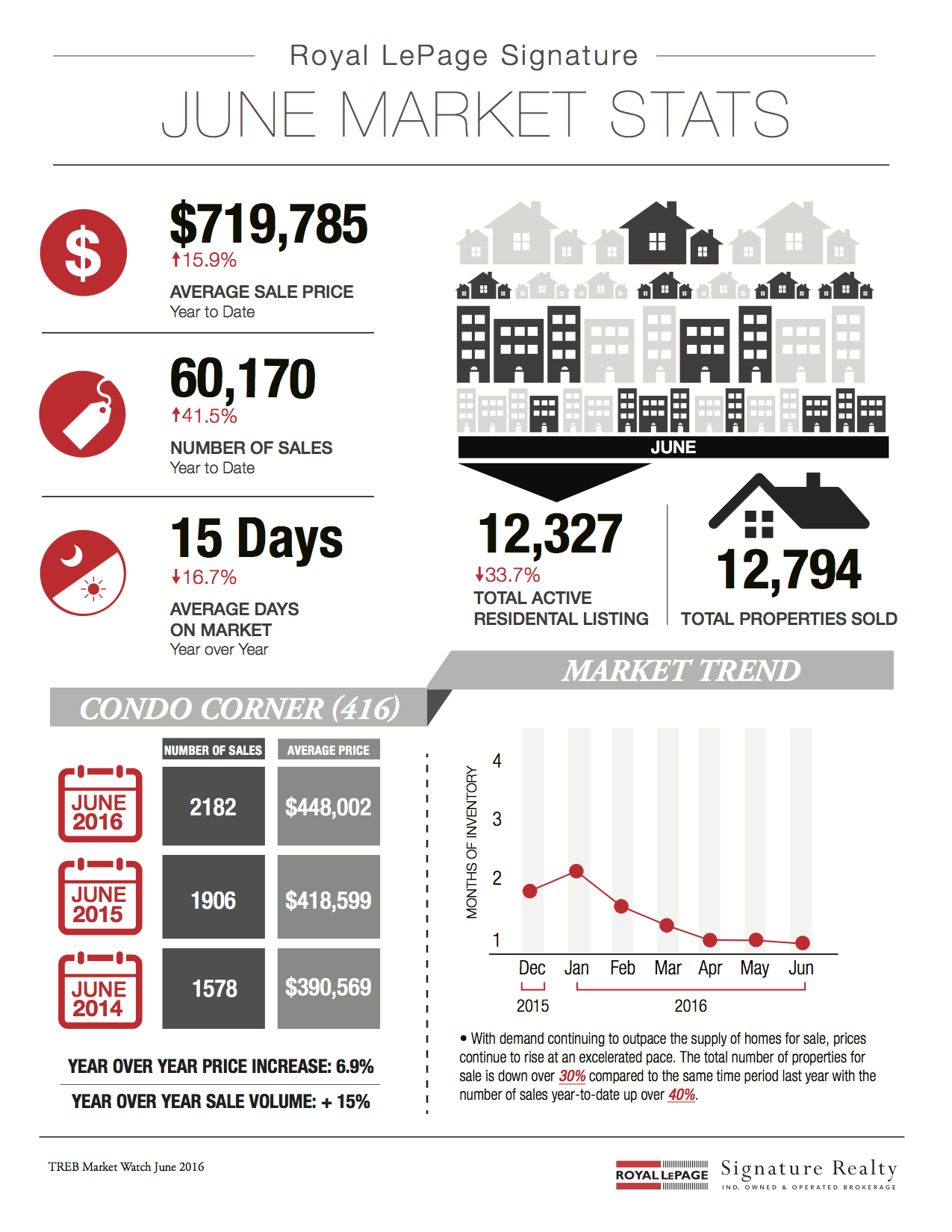

Following is TREB’s market report for August 2016: Following is TREB’s market report for June 2016:

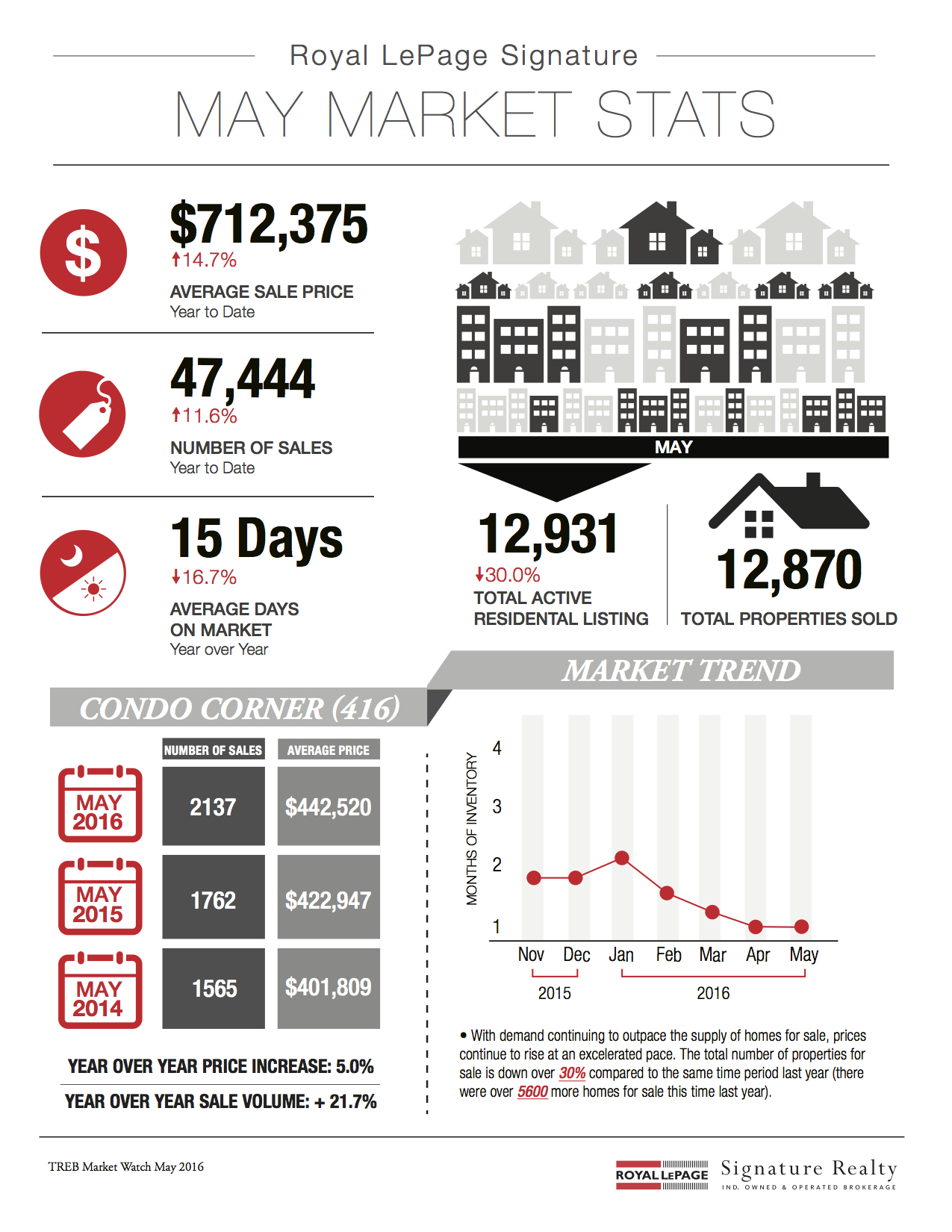

Following is TREB’s market report for June 2016: Following is TREB’s market report for May 2016:

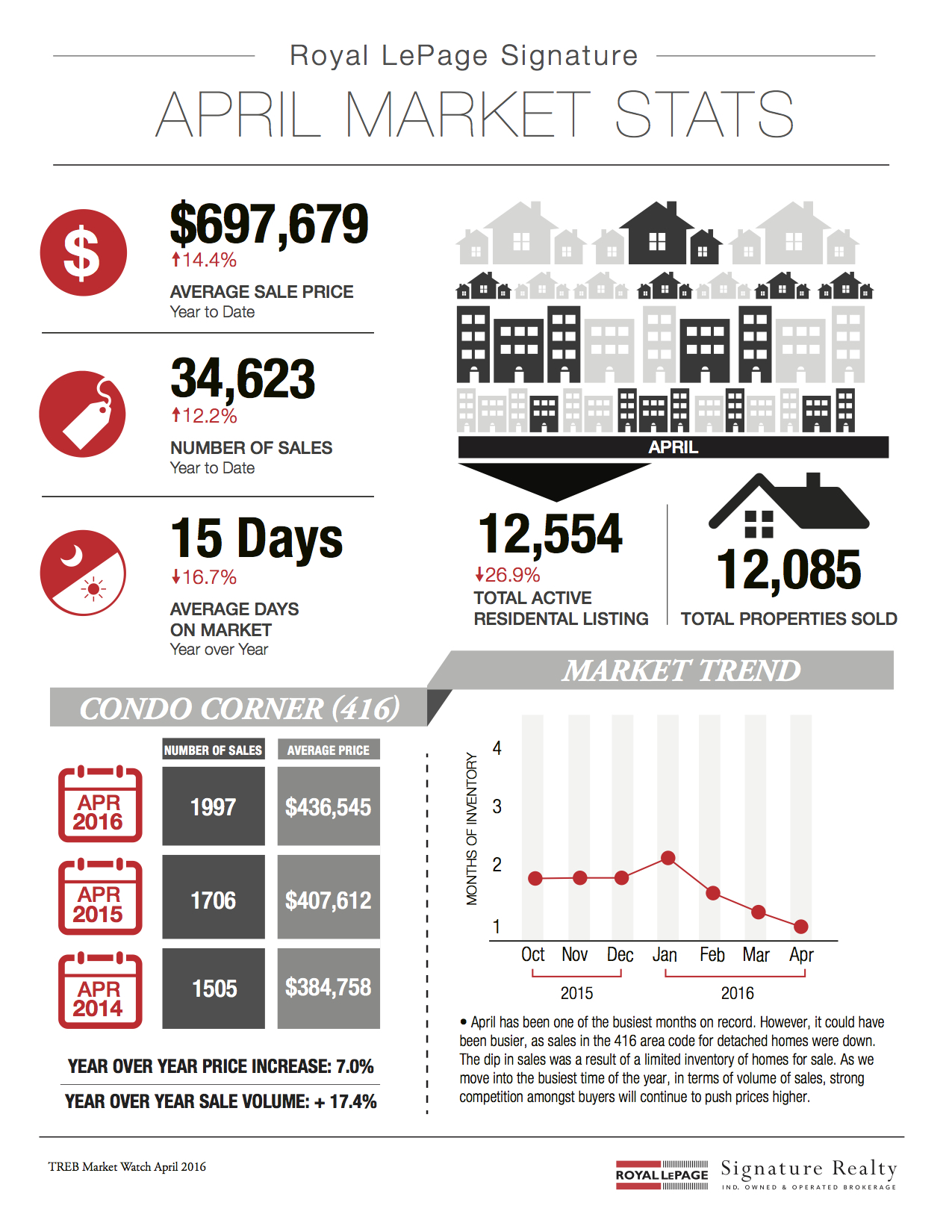

Following is TREB’s market report for May 2016: Following is TREB’s market report for April 2016:

Following is TREB’s market report for April 2016:

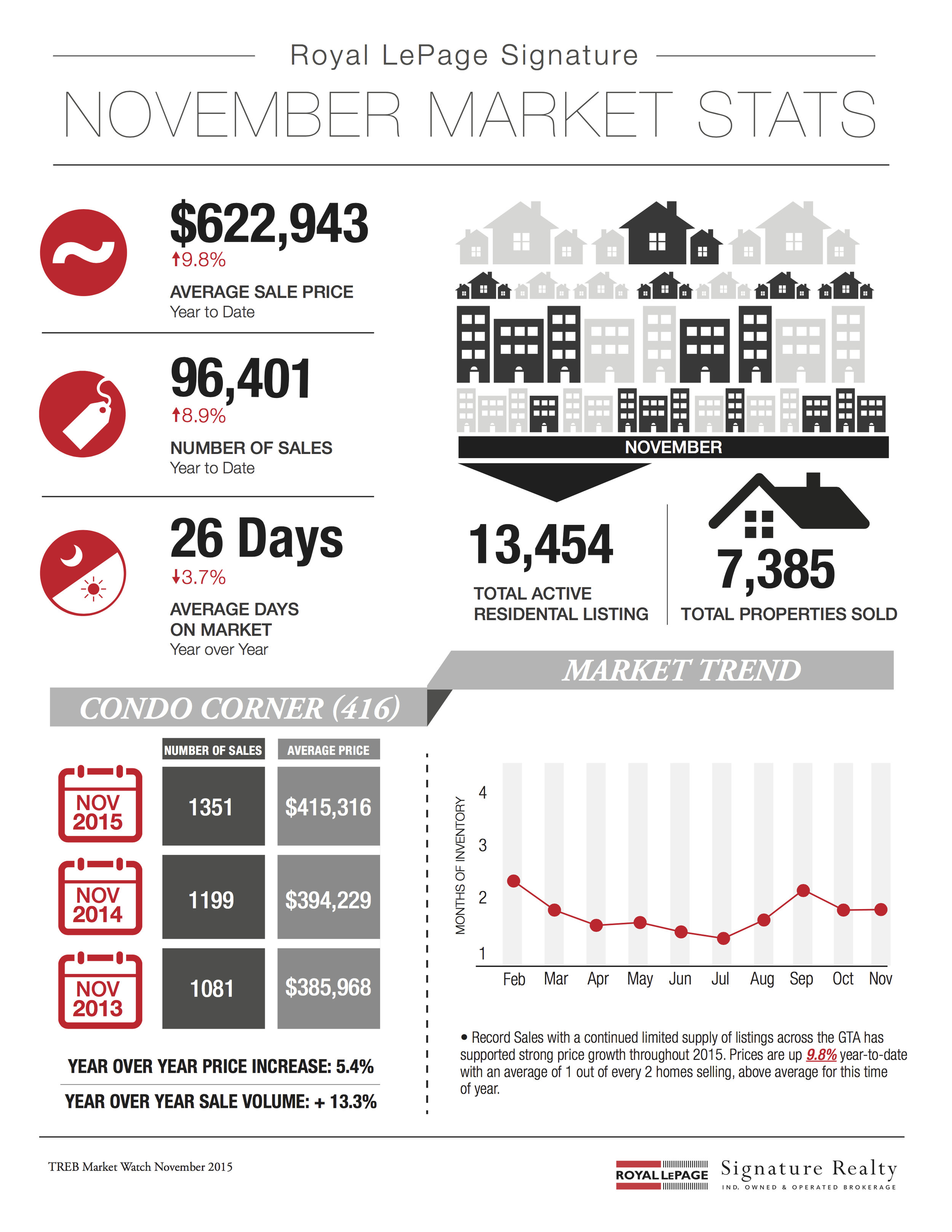

Following is TREB's market report for November 2015:

Following is TREB's market report for November 2015:

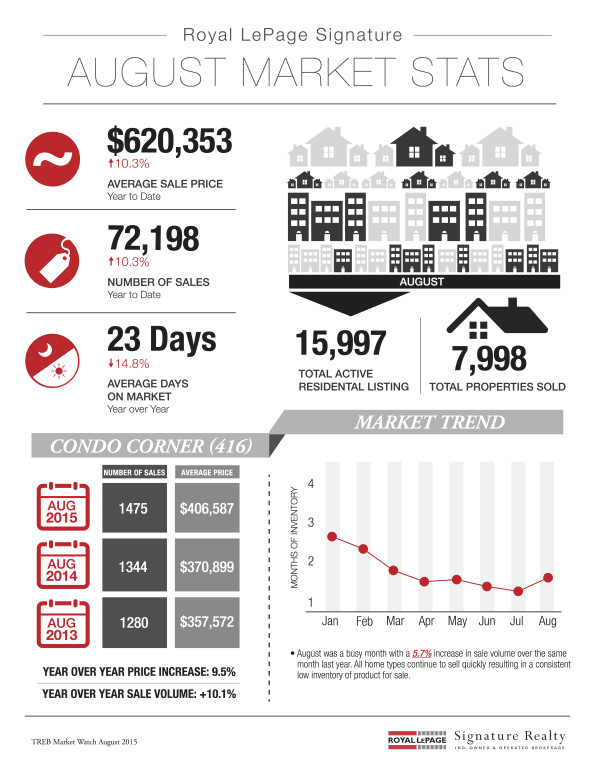

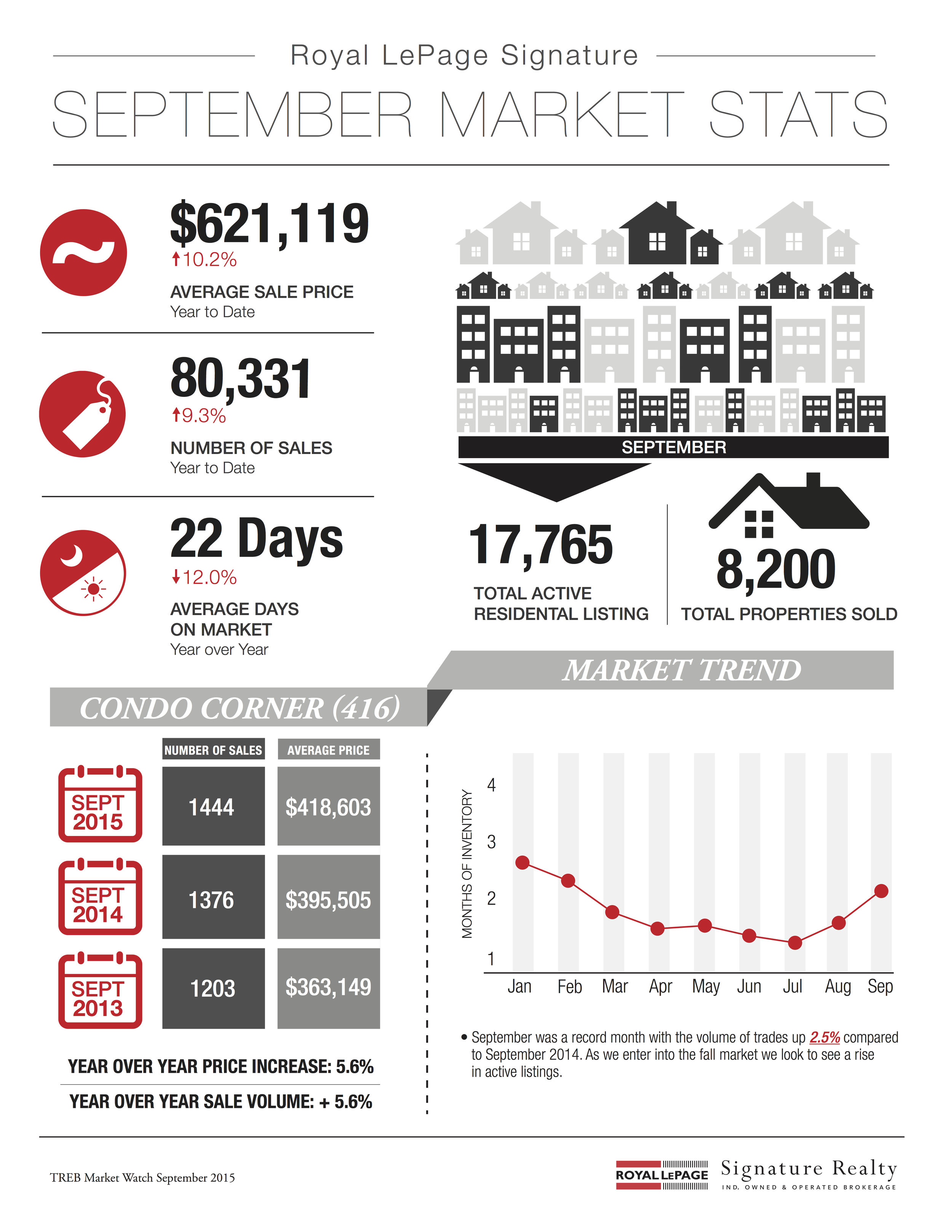

Following is TREB's market report for September 2015:

Following is TREB's market report for September 2015: